United Kingdom

Apax reshuffles senior management team

Ralf Gruss (pictured) has been appointed chief operating officer at Apax Partners following his predecessor's move to become full-time head of the firm's portfolio support group.

Octopus hires two

Octopus Investments has hired Frederic Lardieg and Simon King.

Endless exits Phoenix Foods to Specialty Powders

Turnaround specialist Endless has sold Phoenix Foods to trade player Specialty Powders in an all-cash transaction.

Maven backs four energy services companies

Maven Capital Partners has invested ТЃ5m of mezzanine funding in Scottish SMEs operating in the energy equipment and services sector.

LDC backs MBO of Dale Power Solutions

LDC has invested ТЃ10.5m to back the management buyout of power solutions provider Dale Power Solutions.

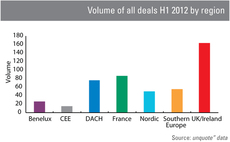

UK dominant as European deal activity stumbles

The UK has reasserted its dominance as a European private equity market in 2012, racing ahead of the competition, according to figures from unquoteт data.

Inflexion closes £100m co-investment fund

Inflexion Private Equity has closed its 2012 Co-Investment Fund on its ТЃ100m hard cap, six weeks after sending out PPMs.

Foresight rocks out with £3.5m Blackstar investment

Foresight Group has injected ТЃ3.5m into UK-based guitar amplifiers manufacturer Blackstar.

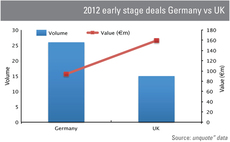

Early-stage investments: German deal volume booms

While German early-stage activity has risen in volume in the first half of 2012, the UK holds its own with strong overall deal value.

North West Fund backs Dot Medical

The North West Fund for Biomedical, managed by Spark Impact, has invested ТЃ550,000 in Dot Medical, which manufactures equipment to treat heart conditions.

Key Capital Partners backs £15m MBO of Nurse Plus

Key Capital Partners has backed the ТЃ15m MBO of UK-based healthcare staffing company Nurse Plus.

ISIS invests £5.2m in Pho

ISIS Equity Partners has committed to a ТЃ5.2m staged investment in independent UK-based Vietnamese street-food group Pho.

Dunedin's CitySprint acquires Scarlet Couriers

UK-based distribution network CitySprint, backed by Dunedin Capital Partners, has acquired courier firm Scarlet Couriers.

Hutton Collins and LGV back Novus Leisure MBO

Hutton Collins and LGV Capital have backed the management buyout of bar and club operator Novus Leisure, which notably runs the Tiger Tiger brand.

Finance Wales et al. complete Clinithink series-A

Finance Wales has taken part in the multi-million-dollar second tranche of a series-A funding round for UK-based healthcare software company Clinithink, alongside existing investors.

LDC takes Boomerang private

LDC has acquired AIM-listed media production company Boomerang in a take-private worth close to ТЃ8m.

North West Fund backs PlaceFirst

The North West Fund for Energy & Environmental, managed by CT Investment Partners, has acquired a minority stake in UK-based energy and regeneration business PlaceFirst.

Octopus appoints new investment director

Octopus Investments has appointed Shay Ramalingam as investment director in its specialist finance division.

RCapital Partners backs bChannel MBO

RCapital Partners has supported the MBO of UK sales channel management business bChannel.

Equistone in talks for Explore Learning

Equistone Partners Europe is in exclusive talks to acquire Explore Learning, a UK-based firm offering maths and English tuition to 5-14-year-olds.

Rothschild closes first European secondaries fund on €259m

Rothschild has held a final close for its Five Arrows Secondary Opportunities III (FASO III) fund, exceeding its initial target of тЌ200m.

Rutland appoints investment exec

Turnaround investor Rutland Partners has appointed Michael Reynolds as investment executive.

Mobeus in £18m Tessella MBO

Mobeus Equity Partners has pumped ТЃ18m into science-focused technology and consulting services provider Tessella, marking the GP's first buyout since its spinout from Matrix Group.

Imperial Innovations in £17m round for Cell Medica

Imperial Innovations Group has invested in a ТЃ17m funding round for its portfolio company Cell Medica.