Analysis/Buyouts

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater

Sponsors drive record take-private activity as deployment pressure mounts

Discounted small- and mid-cap take privates expected to feed 2 pipelines amid M&A and IPO slowdown

GP Profile: Limerston Capital anticipates higher volume but more complex M&A as market steadies

UK-based GP is seeing dealflow driven by carve-outs and buy-and-build in a market where organic multiple arbitrage is no longer a given

Lenders sway fate of auctions in volatile LBO market

Vendors increasingly sounding out lenders before bidders to navigate uncertain M&A landscape

German health minister’s 'locust sponsors' comments spook live healthcare deals

New entrants scared by remarks on limiting profits; existing investors expected to rush to complete bolt-ons

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

Gatemore eyes larger stakes in listed SMEs as path to take-privates

With its first closed-end fund in the making, the activist investor will use larger stakes to drive value creation and direct small-cap targets towards PE sales

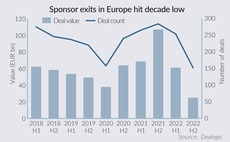

Final close: Sponsors fight through buyout fundraising drought

With EUR 100.5bn in commitments this year, European buyout fundraising is likely to be the lowest since 2018

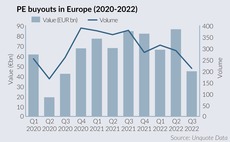

Private equity buyouts hit lowest point since COVID

Amid macro uncertainty, sponsors see EUR 44.6bn deployed across 211 buyouts, in the lowest mark since Q3 2020

Foreign GPs step up for large Italian deals – panel

Interest from international players is growing across a variety of sectors, but political uncertainty looms

Morrisons rival bidders may have little room to improve on Fortress bid

Both CD&R and Apollo are seen as viable threats to Fortress’s offer, one source says

European consumer M&A presents opportunities in Covid-19 chaos

Europe's consumer sector offers pockets of opportunity as the coronavirus pandemic wreaks havoc on M&A

Viridor/KKR shows sponsor route to waste opportunities in Covid-19 market

Waste management, and particularly energy-from-waste, is fast becoming an area of heated dealflow

GP Profile: Cerea Partenaire

Three-pronged food and agriculture investor is due to announce a first close for its second debt fund in March ahead of a final close on its €300m target

Deal in Focus: IK buys Studienkreis from Aurelius

IK had considered previous opportunities in the education space, with the firm's partner Petersson saying the sector offers good opportunities for PE

Deal in Focus: Ardian merges Spanish bakeries Berlys and Bellsolà

Ardian's investment in Berlys and Bellsolà forms part of a consolidation play in the European frozen food industry

Deal in Focus: Ambienta carves out Restiani from Total Erg

An in-depth look at a difficult carve-out in the energy production market segment

Deal in Focus: Ambienta bets on tighter market regulation with Safim

A look at the rationale behind the GP's 25th investment since the launch of its maiden fund in March 2008

Deal in Focus: Ufenau reaps 6x on NRW sale

Divestment of building refurbishment company follows a tenure of less than three years

Deal in Focus: Eurazeo buys Mondelēz confectionery arm for €157m

Following the deal, the company's international production will be relocated to France

Deal in Focus: Bain and Cinven to take Stada private

Acquisition of German pharmaceutical company would be the largest buyout ever recorded in the country

Deal in Focus: Ardian to take majority stake in Prosol

French hypermarket group reportedly valued in the region of €1bn, with existing investors remaining as minority backers following completion

Deal in Focus: Wise backs Tapì’s SBO

Italy-based bottle cap producer will adapt its expansion strategy to account for geopolitical developments in Central and North America

Deal in Focus: Cobalt makes 3.5x on TCS sale to Meeschaert

Vendor extended its holding period with LPs' blessing in order to fully implement its buy-and-build growth strategy