Analysis

Video: Travers Smith's Sam Kay on fundraising's paradigm shift

Unquote interviews Sam Kay from Travers Smith, finalist in the Fund Structuring category at the 2020 British Private Equity Awards

Video: Frog Capital's Mike Reid on growth equity's chance to shine

Reid recaps a busy year for Frog and shares his experience of dealing with the Covid-19 crisis

Video: Proskauer's van Zyl discusses fund formation trends

The Proskauer partner recaps the firm's mandates over the past year and how the market reacted to the coronavirus crisis

Video: Alantra's Andy Currie on the outlook for PE

Unquote interviews Andy Currie from Alantra, winner in the Corporate Finance Firm Of The Year category for the 2020 British Private Equity Awards

BVCA summit: fund financing boom necessitates tailoring

Market participants discuss IRR-enhancing tactics, emergency liquidity and negotiations with LPs

GP Profile: Silverfleet eyes fundraising progress, new acquisitions

Firm is currently raising for Silverfleet Capital Partners III, which was registered in July 2019

Co-investment: get out or double down?

While some LPs could be overexposed to troubled sectors, others could up their game and deploy into opportunities arising mid-cycle

GP Profile: Sparring Capital in final push for €200m fundraise

French GP, previously known as Pragma Capital, is aiming for a final close in the next six months, having collected around two thirds of its target

GP Profile: Searchlight sees opportunity in volatility

Following an interim close for Searchlight Capital Partners' latest fund on $3.1bn, founding partner Oliver Haarmann details the firm's strategy

Italian PE players highlight silver linings amid crisis

Fundraising challenges, portfolio support and new opportunities were key themes discussed at last week’s Unquote Italian Private Equity Forum

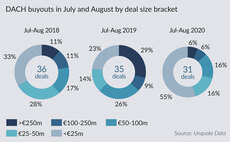

DACH buyout deal value sees sharp summer decline

Following a quiet period for upper-mid-cap dealflow, Unquote gauges market sentiment as to whether activity could pick up before year-end

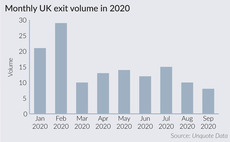

UK exits set to drag in Q3

Early figures from the third quarter suggest that very few GPs will be in sell mode for the rest of the year

Unquote Private Equity Podcast: Allocate 2020 special

The Pod discusses our upcoming LP/GP conference, Allocate, touching on illiquidity solutions, secondaries, and ESG

VC Profile: VNV Global

Managing director Per Brilioth discusses portfolio company Voi, seeking network effects and investing in companies at the idea stage

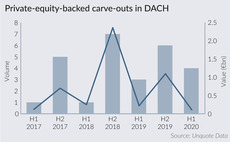

PE players await DACH carve-outs uptick

With corporates under pressure due to the coronavirus pandemic, opportunities are likely to open up for sponsors interested in carve-outs

GP Profile: Sherpa Capital

Spanish GP Sherpa Capital has recently held a final close on €120m for its new fund Sherpa Special Situations III

Secondary market update: coming out of hibernation

After a pause in activity, the market is gearing up for a busy final quarter, says Rede Partners' Adam Turtle

DACH lender sentiment continues to improve – survey

Leverage has not changed significantly for resilient assets, which are still prioritised

GP Profile: ArchiMed

Following the close of its new €1bn fund, ArchiMed's Denis Ribon discusses the firm's fundraising experience and investment pipeline

Unquote Private Equity Podcast: H2 Preview

The Unquote Podcast gathers the whole team this week to go over H1 statistics, look at early recovery signs and share insights from across Europe

GP Profile: Egeria

Hannes Rumer, a partner in Egeria's new Munich office, discusses the GP’s strategy and deal pipeline for the DACH region

DACH holds up under pandemic pressure, but recovery doubts remain

Market players suggest it is unlikely that H1 figures reflect the extent of the damage done to portfolios and M&A

Southern Europe bounces back amid pandemic uncertainty

Southern European market has regained vigour and confidence in July following a catastrophic H1

EQ Asset Management eager to deploy following double fund close

EQ says it has completed five acquisitions through its secondaries fund since the outbreak of Covid-19