Analysis

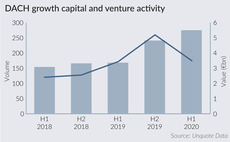

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

GP Profile: FPE Capital

FPE Capital is now gearing up to begin making investments again in the technology sector, says managing partner David Barbour

Debt funds making inroads in DACH amid Covid-19, says GCA

GCA's Mid Cap Monitor shows that debt funds financed 71% of German LBOs in H1 2020, with the firm expecting an activity uptick in Q4

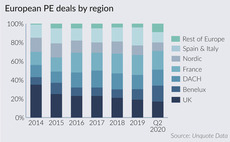

Venture, tech keep UK market afloat in H1

Buyout and exit volume dropped dramatically in the first half of 2020, while GPs are doubling down on technology-driven strategies

Unquote Private Equity Podcast: Made in Germany

This week, the Unquote Podcast focuses on Germany, where private equity activity has remained resilient despite Covid-19

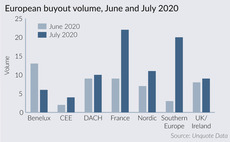

France, southern Europe drive dealflow uptick in July

Buyout market is picking up again following one of the worst slumps on record, with some of the regions originally hardest hit becoming busier

How the crisis could affect fund T&Cs

In a tough funrdriasing and deal market, GPs will be looking for all the incentives they can possibly provide

Finland's VC industry remains buoyant despite pandemic

Dealflow in the Finnish VC market remained strong in the peak months of the coronavirus outbreak, with local players cautiously optimistic

GP Profile: Tenzing Private Equity

Following a busy start to 2020, topped by its ТЃ400m fundraise, Tenzing is setting its sights on making further investments later this year

Unquote Private Equity Podcast: Calling tech support

This week, the Unquote Podcast talks all things technology with Intuitus chief commercial officer Adrian Astley Jones

Fashion victims: GPs face a tough year in the clothing & accessories sector

Unquote explores dealflow expectations and potential silver linings for the segment, which has been one of the hardest hit by the pandemic

VC Profile: Edge Investments

As the firm begins raising its second fund, chief IR officer David Fisher discusses the current portfolio, LP sentiment and the creative economy

2011-vintage funds: what is still in Nordic portfolios

Unquote and Mergermarket round up a selection of assets still held in 2011-vintage funds managed by Nordic GPs

GP Profile: Emeram Capital Partners

DACH-focused GP anticipates the launch of its second fund following a portfolio assessment and digital AGM

Virtual Briefing: ESG and rebalancing through secondaries

Palico's Woolston Commons, Cambridge Associates' Varco and Unigestion's Newsome discuss whether the current crisis will lead to an ESG rethink

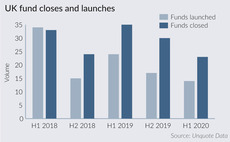

UK fundraising update: pausing for breath

A number of GPs that closed more than three years ago have delayed fresh fundraises, or have altogether decided to explore new options

GP Profile: Priveq Investment

Sweden-based GP completed fundraising for its sixth fund entirely online

Market sentiment improving but dealflow likely to remain bifurcated – Baird

Baird MDs Vinay Ghai and Paul Bail discuss deal-making amid the pandemic and emerging trends for the months ahead

Fund Profile: Ardian Secondary Fund VIII

Ardian discusses with Unquote its secondaries activity and outlook on market trends amid the pandemic

Unquote Private Equity Podcast: Fundraising engine stalls

This week, the Unquote Podcast examines the fundraising market amid the challenges of Covid-19

LP Profile: CPP Investments

Unquote picks out key takeaways from CPPI’s latest annual report, and hears from head of PE funds Delaney Brown about the Canadian LP's strategy

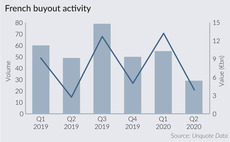

Lockdown impact derails French buyout momentum

Even as France is now moving on, the uncertain road ahead is threatening to undo months of improving activity and market sentiment

GP Profile: Genesis Capital

Managing partner Ondřej Vičar discusses the launch of the firm's latest fund, as well as portfolio management and investing during the coronavirus pandemic

Nordic e-commerce confident "silver krona" uplift will persevere

Lockdowns have т out of necessity т introduced a new age group to online shopping, boosting prospects for several PE-backed assets