How European venture capital weathered a rocky 2020

The European VC market has quietly kept on building a head of steam in the past 12 months, regardless of a pandemic that otherwise threatened to cripple entire sections of the private equity industry, Unquote Data shows

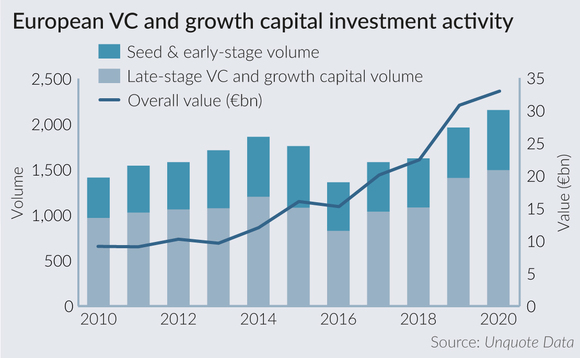

European venture capital enjoyed a robust 2020, certainly when it comes to deployment, according to Unquote Data. Looking at the entire segment, dealflow was up 10% year-on-year compared with 2019 numbers, with aggregate value ever so slightly down – but, at €32.9bn overall, still way ahead of the historical average over the previous decade. This is confirmed when looking at the "pure VC" space of seed- and early-stage rounds, where the year-on-year growth rate for dealflow was closer to the 19% mark.

More importantly, the market's momentum was not broken by the onset of coronavirus at the end of Q1 – the second quarter actually reflected an uptick in investment activity, and aggregate value in particular continued climbing in each subsequent quarter as the market became more confident in going ahead with large-scale rounds as the year went on. Data so far indicates that volume in the seed & early-stage segment finished the year on a depressed note – but it remains to be seen if this trend is verified once more deals invariably come to light through secondary research in the coming weeks.

The reasons why venture appeared to take the unprecedented events of 2020 in its stride are fairly self-evident. VC players (and the startups they back) are inherently more nimble than their vanilla PE counterparts, and culturally more inclined to work completely virtually; they work on less complex transactions that usually do not rely on arranging leverage with spooked lenders; and in the main they focus on sectors that were mostly shielded from, if not net beneficiaries of, the pandemic's worst impacts.

Standout early-stage deals

| Company Name | Date | Sector | Country | Value (€m) |

| Inigo | Nov 2020 | Full-line insurance | UK | 687 est |

| Ki | Sep 2020 | Insurance brokers | UK | 419 |

| Medtronic Diabetes Group | Jun 2020 | Medical equipment | Ireland | 304 |

| Lilium Aviation | Mar 2020 | Aerospace | Germany | n/d (100-250m) |

| Immunocore | Mar 2020 | Biotechnology | UK | 118 |

| Atai Life Sciences | Nov 2020 | Biotechnology | Germany | 107 |

| SellerX | Nov 2020 | Broadline retailers | Germany | n/d (50-100m) |

| VectivBio | Oct 2020 | Biotechnology | Switzerland | 94 |

| Neogene Therapeutics | Sep 2020 | Biotechnology | Netherlands | 92 |

| Isar Aerospace | Dec 2020 | Aerospace | Germany | 75 |

Source: Unquote Data

Of course, the full picture is more complicated than the headline statistics would suggest. From a regional perspective, not all European markets reacted to 2020's events in the same way. Standouts included the DACH countries, which continued building on the momentum initiated in the latter half of the 2010s and recorded a strong VC uptick in the past 12 months; and southern Europe, where Italy and Spain's VC scenes recovered after a more subdued 2016-2019 period.

Meanwhile, LP appetite for the strategy looks to have been mostly unaffected by the crisis: aggregate commitments for European venture fund closes have remained very consistent at around the €9bn mark per year over the past five years, according to Unquote Data, and 2020 was no different – even though the number of final closes was slightly down compared with 2019.

With more than 100 European VC funds currently on the road, managers will no doubt hope the resilience shown by the sector in these tumultuous times – and the underlying investment opportunities turbocharged by the pandemic – will resonate even more with investors worldwide.

Listen to the Unquote team and Simon Philips, CEO of ScaleUp Capital, discussing key takeaways and the outlook for the European venture space in the latest episode of the Unquote Private Equity Podcast

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Multi-family office has seen strong appetite, with investor base growing since 2016 to more than 90 family offices, Meiping Yap told Unquote

Permira to take Ergomed private for GBP 703m

Sponsor deploys Permira VIII to ride new wave of take-privates; Blackstone commits GBP 200m in financing for UK-based CRO

Partners Group to release IMs for Civica sale in mid-September

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Change of mind: Sponsors take to de-listing their own assets

EQT and Cinven seen as bellweather for funds to reassess options for listed assets trading underwater