Articles by Carmen Reichman

Patience pays off on Ziggo IPO

The unusual IPO story of Ziggo has presented yet another boost to its private equity backers as overwhelming investor demand accelerated yesterday’s share offering from a planned 18 million to 29 million ordinary shares - trading at a premium of 34%....

HTGF et al in series-B for Customer Alliance

High-Tech Gründerfonds (HTGF), Mountain Super Angel, K5 Ventures and netSTART Venture have invested in a second round for Berlin-based software-as-a-service provider Customer Alliance.

Equistone takes majority stake in Vivonio

Equistone Partners Europe has taken a 67% stake in German furniture maker Vivonio Furniture Group, a newco formed by combining Orlando Management-backed MAJA, Staud and SCIAE.

ISIS invests £5.2m in Pho

ISIS Equity Partners has committed to a £5.2m staged investment in independent UK-based Vietnamese street-food group Pho.

Evonik invests in Pangaea Ventures fund

CVC-backed German speciality chemicals maker Evonik has invested in Pangaea Ventures Fund III through its recently established venture unit.

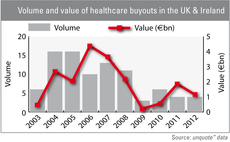

Are buyout firms well placed for healthcare reforms?

UK healthcare

Mid Europa backs Walmark

Mid Europa Partners has acquired a 50% stake in Czech dietary supplements manufacturer Walmark from the company's founders.

Cross acquires Micromacinazione

Swiss firm Cross Equity Partners has acquired a majority stake in Swiss micronisation technologies and services company Micromacinazione.

Blackstone France appoints chairman

Blackstone's special adviser Gerard Errera has been appointed as chairman of Blackstone France.

T-Venture backs DropGifts

T-Venture has backed Berlin-based social gifts start-up DropGifts with a seven-digit-euro investment.

Perusa buys TLT Group

Perusa has wholy acquired German automotive logistics business Trans-Logo-Tech Group (TLT) via its €207m Perusa Partners Fund II.

Omnes Capital invests in Unafinance MBI

Omnes Capital (formerly Crédit Agricole Private Equity) has backed the management buy-in of French building security company Unafinance.

AXA PE buys Schustermann & Borenstein

AXA Private Equity has bought German fashion exporter Schustermann & Borenstein in an MBO that reportedly values the company at $370m.

Index et al. partially exit Funxional Therapeutics

Index Ventures, Novo A/S and Ventech have partially exited their investment in Funxional Therapeutics, following the company’s sale of its rights to lead anti-inflammatory drug FX 125L to German pharmaceuticals company Boehringer Ingelheim.

Connection Capital appoints two

UK private client firm Connection Capital has appointed Robert Clarke as head of its investment committee and Julian Carr as investment director in the private equity team.

Arts Alliance et al. back RollUp Media

Arts Alliance and a group of individual investors have injected €1.2m into UK-based online platform for publishers RollUp Media.

Former Metro boss launches PE house in Germany

Former Riverside partners Kai Köppen and Volker Schmidt have partnered with ex Metro boss Eckhard Cordes and former Apax partner Christian Näther to form a new buyout house in Munich, local reports suggest.

Renewed confidence in alternative energy

Alternative energy

Sun-backed Neckermann files for insolvency

Sun European Partners' German mail-order portfolio company Neckermann has filed for insolvency following unsuccessful talks with the PE firm.

HTGF et al. invest €1m in Data Virtuality

High-Tech Gründerfonds (HTGF) and Technologiegründerfonds Sachsen (TGFS) have invested €1m in German software start-up Data Virtuality.

HPE Holland backs Cotesa with €20m

HPE Holland Private Equity has invested €20m in German fibre-reinforced composites manufacturer Cotesa.

Capvis and Partners Group sell Bartec to Charterhouse

Capvis Equity Partners and Partners Group have sold their majority stake in German industrial safety technology provider Bartec to Charterhouse Capital Partners.

Cipio et al. back wywy with €2.5m investment

Cipio Partners, business angel Tobias Schmidt and other investors have provided German second-screen service provider wywy with €2.5m of venture capital.

Exponent appoints Davidson as partner

UK-based mid-cap GP Exponent Private Equity has promoted Simon Davidson to become its seventh partner.