Articles by Greg Gille

A year to remember - and learn from

Unquote recaps a year like no other, and maps out what market players expect when it comes to dealmaking and fundraising from 2021

Download the December 2020 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers

Alder to start raising new fund in H2 2021

Sponsor is currently investing from Alder II, which closed on its hard-cap of SEK 1.5bn in 2019

Multiples Heatmap: average entry multiple hits 10.5x as dealflow recovers

The UK and Ireland was the hottest region for multiples in Q3, also seeing the largest increase in valuations of any region

Novalis Biotech aims for January second close for new €25m fund

Belgian VC Novalis held a first close on €8m for its second fund on 8 November

Travers Smith selects new managing partner

Edmund Reed joined Travers Smith in 1994 and became a partner in 2005

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

TA Associates appoints new head of IR

Andrew Harris served in investor-focused roles at Advent International for more than eight years

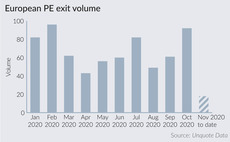

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

Graphite promotes new investment director, hires two

UK mid-cap GP Graphite Capital makes one promotion and two new appointments in its investment team

Finatal launches dedicated PE recruitment practice

New practice complements Finatal Portfolio, which focuses on sourcing talent for PE-backed businesses

Andera, Capza reinvest in Octime in minority SBO

Andera (then EdRip) acquired a majority stake in the business along with management in 2016

Chiltern backs Inciner8 buyout

Chiltern is an evergreen investor that provides equity cheques of £3-15m

GHO, co-investors complete Envision deal

Ardian and GHO started exploring options for the sale of Envision in May, with a deal struck in July

Buyout rankings: who has invested most across Europe since April?

EQT, Ardian and KKR remained very active and struck sizeable deals amid the coronavirus turmoil

LionRock rescues Clarks in £100m deal

Asian GP will acquire a majority stake in Clarks as it enters a company voluntary agreement

HAL backs two Dutch greenhouse businesses

Dutch investment company secures 60% stake in Stolze and a 24% interest in Prins Group

Grant Thornton appoints new head of UK corporate finance

Woodley has been with Grant Thornton for 15 years in the M&A practice, having joined from 3i in 2005

Epidarex sells Sirakoss to VC-backed OssDsign

Epidarex Capital initially backed the £3.1m series-A for the bone graft substitutes developer in 2014

LBO France completes FH Ortho trade sale

LBO France acquired the company via its €154m Hexagone III fund in 2014

LDC backs Rhino Products MBO

Deal is led by the firm's Manchester team, and values the business at £36m

G4S rejects offer from BC's Gardaworld

Company says Gardaworld's offer is "nowhere near a full and fair price"

Claret Capital takes over Harbert European Growth Capital

Claret secures the GP and its funds, and hires the entire HEGC investment team

Kartesia injects €75m into HeadFirst

Kartesia backs the recruitment company via its KCO IV and KCO V funds