Articles by Greg Gille

Q&A: 3i's Gold and Andersen on unlocking e-commerce's potential

3i directors discuss the firm's approach to the sector, and the pitfalls that investors and management teams need to navigate

Video: "A day in the life" of Beringea CIO Karen McCormick

McCormick shares her experience of a typical day working from home, and her outlook for venture and growth capital trends in 2021

Ufenau to target €800m for next vehicle

Swiss GP plans to launch Fund VII in mid-2022, according to managing partner Ralf Flore

Prime Fund aiming to close 10 new investments this year

Newly launched Czech technology fund is open-ended and aims to raise CZK 1bn in total

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

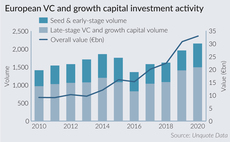

How European venture capital weathered a rocky 2020

Q2 reflected a nice uptick in investment activity, and aggregate value continued climbing as the year went on

TEP Capital to build portfolio of six Polish investments

Poland-based TEP Capital was set up a year ago and is funded by German conglomerate Thomas Gruppe

Siena Venture targets €25m close before year-end

Debut fund from the new VC player held a first close on 1 February

Q&A: Rutland's Birt and Hamilton-Allen

Special situations experts discuss how the pandemic has reshaped opportunities in their market and shone a light on the role investors can play

Download the February 2021 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers

Sagard invests in Flight Simulator developer Asobo Studio

Deal is the second for the Sagard NewGen fund, launched in July 2020 with a €300m target

Gresham House Ventures hires Rupesh Patel

Patel most recently worked at Praesidian Capital, a transatlantic private equity and debt fund

New Baltic fund targets €30m to back female founders

Fund targets Baltic and Nordic startups with female founders and gender-balanced executive teams

Abénex backs Squad MBO, Apax exits

Apax Partners Development (formerly EPF Partners) invested around €10m in the cybersecurity firm in 2017

Ardian, BNP Paribas back Proteor

Capital injection facilitates the acquisition of US-based Freedom Innovation

Arbour leaves Palamon for ICG

Philippe Arbour was made partner in early 2019, having joined Palamon in 2013 from Lloyds

Capza secures minority stake in Ynov

Education group manages eight campuses in France with more than 5,700 students

Cipio hires new venture partner

Firm also promoted David Kreppel to principal and Dennis Koerner to senior associate

Ace Aero Partenaires nets further €100m commitment

Crédit Agricole, its regional subsidiaries and LCL push the fund closer to its €1bn target

IK invests in Valoria Capital

GP invests via IK Small Cap II Fund, while Idinvest provides financing for the transaction

Unquote Private Equity Podcast: France 2020 review

Katharine Hidalgo welcomes Unquote editor Greg Gille to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

Ardian buys AD Education

BC Partners and CVC were also reportedly among suitors mulling a bid for AD Education

Tikehau Capital hires new CFO

Prior to joining Tikehau, Antoine Onfray was group deputy CEO of listed real estate group Paref

Unquote Private Equity Podcast: UK & Ireland 2020 Review

Early figures highlight how a 2008-style meltdown was averted in 2020, both in terms of deal-doing and fundraising