Articles by Greg Gille

Polaris et al. buy Danica Pension Sverige

Consortium is led by Polaris and Acathia, and comprises Sampension and Unigestion, among others

PAI's Perstorp sells Capa to trade

Perstorp, a Swedish chemicals business, sells its Capa division to Ingevity for €590m

EQT raises €2.3bn for Mid-Market Credit II fund

Available capital, four times the size of its predecessor, includes anticipated leverage

RJD reaps 92% IRR on Barber of Sheffield exit

RJD Partners acquired a majority stake in Barber of Sheffield just two years ago

Omers-backed Trescal makes two overseas bolt-ons

French calibration services specialist buys Texas-based MATSolutions and Asia-based NorthLab

Ciclad backs VitrineMedia OBO, Siparex exits

Previous backer Siparex sells its minority stake in the business, having invested €1m in 2013

Mezzanine Management closes fourth fund on €264m

Central-Europe-focused mezzanine specialist raises its largest ever vehicle, banking on support from local LPs

PE-backed Sentryo raises €10m series-A

French industrial internet cybersecurity specialist previously raised a €2m seed round in 2016

Video: EQT's Hanna Grahn talks ESG, impact investing

EQT senior sustainability specialist Hanna Grahn discusses the firm's approach to ESG and impact

Main Capital's GoConnectIT bolts on Geodan van den Berg

GP acquired the supplier of specialist software for the infrastructure sector last year

Video: Goodwin's Ed Hall on Nordic macro trends

Goodwin partner Ed Hall recaps a macro-focused panel at the latest Nordic Private Equity Forum

Rutland backs MBO of Total Rail Solutions

Deal is the seventh investment from Rutland's third fund, which closed on £263m in 2015

3i appoints six across PE team

GP hires Simon Andersen as digital director, along with five further hires in Europe and the US

Agilitas-backed Hydro International buys Oxford Scientific

Agilitas acquired the wastewater treatment products and services provider earlier this year

DIP Capital injects £1.5m into Wejo

DIP Capital was established in February 2018 and focuses on investing in disruptive businesses

Chequers sells Cordenka to new Chinese fund

BMC Europe Fund I was launched earlier this year with $480m, and marks its first deal with Cordenka

Waterland's Schönes Leben acquires Gut Köttenich

New bolt-on Gut Köttenich Group operates 14 nursing homes across 11 locations

Quadriga sells Alicona Imaging to Bruker

German GP sells the measuring technology company to a US trade buyer three years after investing

Argos hires two for Paris office

Marc-Olivier Crisan joins as investment director, and Mario Giannattasio as its new chargé d'affaires

Vaaka Partners invests in Nordic Healthcare Group

GP invests via Vaaka Partners Buyout Fund III, which closed on its €225m hard-cap last year

Roivant raises further $200m from NovaQuest et al.

Latest round follows massive $1.1bn investment led by SoftBank Vision Fund last year

Motive Partners buys majority in Lucht Probst Associates

Fintech-focused PE firm buys the German software and advisory services firm

IK's Hansen Protection targets Oslo listing

New shares are expected to raise gross proceeds of NOK 550-600m, with IK also reducing its stake

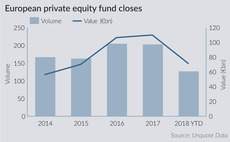

European fundraising cools down after bumper 2017

Number of fund closes by European PE firms and their aggregate commitments have slowed down during 2018, following two years of relentless activity