Articles by Greg Gille

Livingbridge sells VCT business to Gresham House for £30m

Livingbridge steps away from the VCT space in order to focus on its core private equity activities

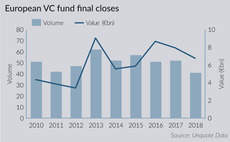

European VC fundraising continues strong showing

VC fundraising totals over 2016-2017 marked a healthy increase of nearly 50% on the amounts raised in the previous two-year period

CapMan holds €115m first close for maiden infra fund

CapMan launched its infrastructure-focused investment business in April 2017

Initiative & Finance sells Fil Rouge to Altavia

Marketing business Altavia is minority-backed by Andera Partners (formerly Edmond de Rothschild Investment Partners)

Inflexion's Radius Payments buys Adam Phones

Acquisition is the first since the minority investment by Inflexion in January

Midlothian acquires HB Education for £467m

India-based Cox & Kings sells its UK education business, with brands including PGL and Travelworks

Germany's Protembis raises $10m series-A round

Series-A round is backed by a consortium of investors including Seed Fonds III

Primary Capital exits Esteem Systems after 14 years

Primary Capital backed the buyout of the IT services company in 2004 via its second fund

Downing appoints new COO

James Weaver joins Downing after four years as chief operating officer at Amicus Finance

Keensight hires new associate director

Theodor Wuppermann joins the mid-market house after a stint at healthcare-focused ArchiMed

Introducing the new Unquote weekly updates

Get our latest content based on your favourite topics, regions and sectors straight to your inbox every week

ECB lending guidelines turn one with little to celebrate

Volume of highly leveraged deals continues to rise, while aggressive adjustments on financial metrics follow suit

EQT Ventures backs Siilo in €4.5m round

Funding will be used to scale up Siilo's user base, with a focus on the UK and Germany

BC hires new investor relations principal

Ardian's Yacine Mancer joins BC to do IR work with a focus on the Middle East region

Landmark backs single-asset secondaries for PAI's Perstorp

PAI has been invested in the speciality chemicals business, the last asset in PAI IV, since 2005

Tail-end funds fuelling secondaries boom

Recent research shows the proportion of tail-end funds in secondaries transactions has been climbing rapidly, reaching a new record in H1 2018

Agilitas appoints new investor relations head

De Pompignan joins from Lyceum, while GP also appoints Rouland as new investment director

Debevoise hires new funds regulatory counsel

John Young joins the firm's funds and investment management group as an international counsel in London

Activa appoints managing partners in succession reshuffle

Michael Diehl sells shares and becomes senior adviser, while brother Charles becomes chair

Northleaf nets $2.2bn for global PE programme

Canadian private markets investor closes its latest secondaries vehicle on $800m

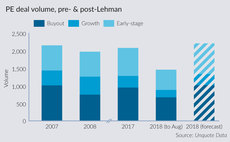

Then and now: European private equity's post-Lehman decade

European PE came to a virtual standstill 10 years ago, but figures show the asset class has all but recovered its pre-crisis appeal

British Private Equity Awards - final call to vote

Final chance to pick your winners in the shortlist for this year's Unquote British Private Equity Awards – voting closes at 5pm today

RPC confirms early takeover talks with Apollo, Bain

GPs now have until 8 October to either announce a firm intention to make an offer or walk away

GIC et al. in $100m round for Acorn OakNorth

Latest funding round values the digital challenger bank at around $2.3bn, three years after inception