Articles by Eliza Punshi

LP Profile: IMCO

Managing director Craig Ferguson discusses accelerated deployment activity during the pandemic and plans to scale up the PE allocation by 2025

Elbrus holds first close on $260m for third fund – report

Fund has a target of $600m, which it plans to reach by next year, according to Kommersant

Korys, FPIM et al. in €12m extended series-B for Remynd

Biotech company initially raised €12m in December 2018

CapMan boosts wealth advisory team

Nordic firm has appointed four people across wealth advisory, alternative investment and marketing

Swanlaab leads $8m series-A round for Landbot

Startup has so far raised $10.2m in funding since being founded in 2017

Lumos Capital leads €16.5m series-B round for Ironhack

Other investors in the round include Endeavor Catalyst and existing investors Brighteye and Creas

Broviken acquires Norwegian HR Prosjekt from Longship

GP will own a 55% stake in the company, while the remaining 45% will be owned by founder Helge Rustand and members of HRP's management

PE-backed Helgstrand Dressage merges with Ludger Beerbaum Stables

Waterland-backed Danish company Helgstrand Dressage has acquired and merged with equestrian show jumping business Ludger Beerbaum Stables.

Full In Partners acquires Danish firm Cybot

Deal value was reportedly 10 times the company's turnover of around тЌ13.4m

Litorina, Bragnum back Nordic Surface Group

Litorina and Bragnum Invest will be co-owners alongside the management and local entrepreneurs, who remain significant co-owners

Nordic Capital promotes two to partner

Pär Norberg heads the investor relations team while Philippe Neuschäfer focuses on lower-mid-market healthcare investments in DACH

Element Ventures leads €15.5m funding for fintech Minna

New funding takes the total the company has raised so far to тЌ23m

EQT Ventures leads $18m round for Sana Labs

Latest round brings its total funding so far to $23m, having previously raised $4m in 2018 and $1m in 2017

AMF leads €52m series-C round for Budbee

Latest round brings Budbee's total funding to date to тЌ92m

IK sells minority stake in Third Bridge to Astorg

IK Investment Partners has entered into an agreement to sell its minority stake in Third Bridge to French private equity firm Astorg.

eEquity, Bonnier Ventures sell Refunder to trade

eEquity exits the company three years after acquiring a majority stake in the company, and achieved a multiple of 3-5x on the transaction

Holland Capital invests in Intercept

Company will use the capital injection to scale up its product development and expand internationally

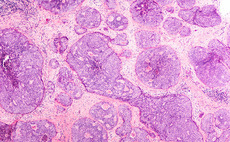

HBM Healthcare leads €127m series-B for IO Biotech

Funding follows the US Food and Drug Administration granting the company breakthrough therapy designation for its lead programmes

BlackRock et al. back Immunocore in $75m series-C

Biotech company has raised $620m in equity and debt since being founded in 2008

Alder sells Nordic Water to trade

Swiss buyer is paying тЌ119m for the company and will see Alder and the management exit the business

Marlin and Francisco to merge Unifaun and Consignor

GPs will be equal shareholders in the combined business and own a majority stake in the company

CVC Capital Partners buys Stark Group from Lone Star

GP paid around тЌ2.5bn for the company, deploying equity from CVC Capital Partners VII

EQT, Verdane to merge Confirmit and FocusVision

Combined company will be led by Confirmit CEO Kyle Ferguson and supported by management of both companies

Sofinnova et al. in €35m series-C round for CorWave

Company has so far raised €80m in funding since being founded in 2012