Articles by Wahida Ahmed

FPE Capital bolsters investment team

Ben Cole promoted to investment director at the software and services growth investor

ECI sells Bionic to Omers reaping 4.8x

Following the sale of the UK-based SME price comparison platform, ECI will reinvest via ECI 10

Ardian exits majority stake in Opteven to Apax

New owner will aim to accelerate the insurance provider's international growth

BGF announces changes in leadership

CIO Andy Gregory to head UK growth investor as Stephen Welton is made non-executive chair

Keyhaven bolsters team with six promotions

Secondaries specialist's promotion include Sarah Brereton's advancement to partner

Eurazeo to reap 3.2x money multiple in Vitaprotech SBO to Apax

French GPs in exclusive negotiations for security specialist deal, which could generate IRR of 30%

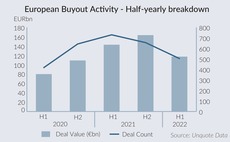

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Hilco Capital agrees rescue deal for Cath Kidston

Investment from distressed retail investor sees Baring Private Equity Asia exit the iconic British brand

Endless holds GBP 100m final close for third SME Fund

Enact III is more than three times the size of its predecessor fund, which closed on GBP 30m in 2019

Equistone, IK invest in PE-backed Safic-Alcan

Paris-headquartered speciality chemical provider’s existing shareholders include EMZ and Sagard

Bowmark backs Cornwall Insight buyout

BGF exits energy markets consultancy following minority stake investment in 2017

Palatine hires investment director from Mobeus Equity

Danielle Garland joins the mid-market sponsor's London buyout team

Riverside Europe exits Brookson to PE-backed People2.0

Sale to TPG-backed staffing platform marks the fifth exit for Riverside Europe this year

YFM exits Ferrabyrne in trade sale

Sale to Sweden-based Dellner Group’s subsidiary marks fourth exit from sponsor’s buyout fund

Charterhouse reaps 4x in SLR Consulting sale to Ares Management

UK environmental advisory group to receive investment from Ares' private equity fund to support growth amid trends towards sustainability

3i, Volpi invest in Digital Barriers

Volpi reinvests in British video compression technology provider alongside 3i and management

LDC hires ESG director from Deloitte

Alex Bexon will help the firm pursue sustainability commitments, such as net-zero operations, by 2030

EcoVadis valued at over USD 1bn in Astorg, BeyondNetZero-led round

Deal brings total raised by sustainability rating group to USD 725m; CVC remains largest institutional shareholder

LDC exits Plimsoll Productions in GBP 131m sale to ITV

Sponsor held a minority stake in the TV production company after a deal that valued it at GBP 80m in 2019

Main Capital on the road for debut growth fund with more fundraises in sight

New vintage of existing strategies and a healthcare-focused continuation fund are also on the agenda for the software-focused GP, according to founding partner and CEO Charly Zwemstra

Schroders Capital hires head of private credit from Federated Hermes

Mark Bruen joins the private asset manager's office in London

EQT, Mubadala to acquire Envirotainer for EUR 2.8bn

Vendors Cinven and Novo Holdings could opt to reinvest in the Swedish medical freight company as minority shareholders

Inflexion reaps 4x on Goals Soccer Centre exit

Sale of the football pitch operator back to founders marks second exit from Enterprise Fund IV

Revaia aims for EUR 400m - EUR 500m final close for Fund II by year-end

VC firm’s second fund is expected to be up to double the size of its EUR 250m debut vehicle