Articles by Francesca Veronesi

Generis Capital et al. back Naskeo

Consortium of investors injects €12m into France-based Naskeo, a biogas plants developer

Waterland opens new office in Zurich

Opening of the Swiss base follows the inauguration of offices in Manchester and Copenhagen

Siparex, Arkea exit Nadia Group

Previous backer Unexo and management reinvest in the France-based industrials group

KKR hires Palamon's Daan Knottenbelt

Knottenbelt will lead KKR's EMEA financial services coverage

Investec hires UniCredit's Bachtler

Former Unicredit director Joerg Bachtler joins Investec's institutional sales group team

Tikehau appoints Laillier as head of private equity

Laillier was a member of the investment and audit committees of Tikehau from 2004 to 2016

BPI France et al. back Qucit

Backers include Urban US, which backs startups seeking to improve the functioning of cities

Eurazeo's CPK in talks to buy Lutti

CPK, the holding company of Carambar & Co, will buy the France-based sweets producer from Katjes

VisVires New Protein Capital et al. back Mitte

Three VC firms in $10.6m seed round for Mitte, a water purification system developer

Nordian Capital backs Codema

Nordian is currently investing via its Nordian Fund II vehicle, closed in 2014 on €300m

FnB Private Equity, Agro Invest buy Valade

French PE houses FnB Private Equity and Agro Invest have jointly bought a majority stake in France-based fruit-processing company Valade Groupe.

Aslanoba Capital et al. back Colendi

Turkey- and UK-based VC firms inject $2.5m into the Zug-based credit scoring platform

PE-backed Vivalto Santé bolts on Capio's French division

French division of hospitals and clinics operator Capio is valued at around €455m

Siparex backs NG Travel in MBO

Olivier Kervella and the management team retain the majority of French tour operator NG Travel

Benelux industrials booming and primed for internationalisation

Sector soars past consumer in terms of aggregate value of H1 buyouts, having historically attracted similar levels of PE backing

CVC sells Stage Entertainment to trade

CVC sells 60% stake in Dutch musical theatre producer Stage to Advance Publications

Newion backs startup PlayPass

Belgium-based PlayPass, a provider of technology services for events, has raised €7.9m to date

Active's Hendrik Veder bolts on Universal Inspection

Hendrik Veder acquires Scotland-based testing and lifting supply specialist Universal

Prime Ventures sells Greetz to trade

Photobox, backed by Exponent Private Equity and Electra Private Equity, buys Greetz

Ardian in talks to buy Trustteam

Ardian is set to acquire Belgium-based IT company Trustteam, owned by Naxicap since 2014

Weinberg eyes Realease Capital

Andera invested in Realease Capital, a professional equipment leasing company in 2015

Avedon sells CycloMedia to Volpi in €100m deal

Investment in Netherlands-based B2B geospatial data business generates a 5x return

Penta-backed GRP buys Digney Grant

GRPтs Irish division Abbey Bond Lovis, a retail broking specialist, buys a majority stake

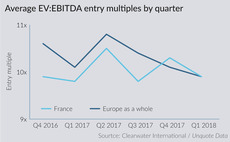

French mid-cap seeks new approaches as competition heats up

Buy-backs edge into the French mid-market, as H1 activity hits record highs and entry multiples swell