Industry

Abraaj files for liquidation in Cayman Islands

GP is seeking a court-supervised restructuring in the Grand Court of the Cayman Islands

Triago to expand London presence

Triago first opened a London office in 2016 but has recently moved to a new address

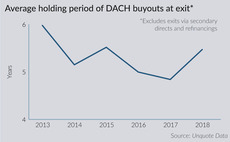

DACH investors turn to value creation to justify high multiples

Three of the five most active private equity firms based in the DACH region last year used non-standard investment models

US investors lag behind Europe on responsible investing – report

Survey finds that 47% of European-based institutional investors have established an RI policy

MCI launches tender offer to wholly own MCI Capital fund

Offer is for 19,003,988 MCI Capital shares in a bid to wholly acquire the fund's shares and votes

Co-investment: Dancing to a new tune

Co-investment has evolved from a value-add into an industry staple, but debate remains as to whether the strategy favours LPs and GPs equally

VC fuels Europe's journey towards self-driving future

Despite the long-term nature of investing in autonomous vehicles and high barriers to entry, fund managers are finding routes into the segment

New regulations set to spur Swedish state pensions investment in PE

Swedish Ministry of Finance presents a proposal to ease investment restrictions for pension funds

Apposite promotes Auffray and Meynier

Auffray becomes head of IR and operations, with Meynier promoted to investment director

Video: Mandarin's Inna Gehrt on DACH opportunities

Inna Gehrt, partner and head of DACH at Mandarin, explores why the region is viewed as an LP magnet

Danish pension funds establish DKK 5bn sustainable development fund

IFU will manage the fund, which has a DKK 5bn target, and aims to raise an additional DKK 1bn

Video: Triton's Marcus Brans on operational expertise

Triton's Marcus Brans discusses the most important way that investors can add value to companies

Idinvest hires former Balderton principal Debock

Investment director Debock will follow venture capital investments in France and Europe

Blossom Capital hires Schroder Adveq's O'Farrell

O'Farrell will be the fifth partner at the VC firm, which was founded in 2017 by Ophelia Brown

Ardian, Edmond de Rothschild exit Siaci Saint Honore

Charterhouse takes over, acquiring a minority stake in the insurance brokerage business

Time Partners hires Schroder Adveq's Kimeze

Kimeze is Time Partners' fifth director and will join the private capital division

BlackFin appoints Franzmeyer to lead DACH expansion

Franzmeyer joins as managing director and will become head of Blackfin in Germany in September

PE-backed UK IPOs outperform, but listings remain slow

Despite a strong track record, PE-backed listings have been few and far between in 2018, but signs of an increase in activity are emerging

KKR's Smidt steps down

Head of industrials and energy Smidt left at the end of May, and has been replaced by Edouard Pillot

LP Profile: Stonehage Fleming

Head of PE Clarke-Jervoise discusses the multi-family office's client base, investment strategy and recent approach to GP relationships

Rutland boosts deal team with two hires

Will Southgate joins Rutland from PwC, while Gessica Howarth previously worked at Goldman Sachs

ESG bridges business and societal cultural gap in France

French GPs are widely adopting more proactive ESG practices in an effort to reflect the country's cultural mindset

Abraaj seeks standstill deal with creditors

Firm has been embroiled in an investor conflict since the beginning of 2018

LP competition heats up for stakes in GP management companies

One in six LPs is taking stakes in GP management companies via specialist funds