Industry

Dutch VC activity reaches all-time high

Biotech and pharma are driving record levels of VC investment in the Netherlands, while venture fundraising continues to perform strongly

Payments sector heats up across the Nordic region

PayPal's $2.2bn acquisition of VC-backed iZettle highlights the Nordic region's leading position in the payments tech market

PineBridge opens Helsinki office

Firm plans on growing its business across European markets with a particular focus on the Nordic region

Korea Post allocates $200m to global buyout funds

Korea Post Insurance plans to allocate $200m to as many as three managers focusing on global buyouts, predominantly in North America and Europe.

Italian PE enjoys vibrant Q1 despite political uncertainty

Buyout and exit activity in the country ballooned in the first quarter of 2018, despite the prolonged uncertainty surrounding the general election

Halder overhauls partner group as part of succession plan

Former partners Paul de Ridder and Michael Wahl step back into senior adviser roles

LP Profile: Pantheon

Managing partner Ward talks to Unquote about the resurgence of separate managed accounts and shying away from first-time funds

Argos Soditic rebrands to Argos Wityu

Maurice Dwek, the founder of Soditic bank, had previously owned a minority stake in the GP

Schroder Adveq reshuffles management following CEO departure

Schroders acquired Adveq in April last year and Schwager was appointed as new CEO in October

Draper Esprit to raise £115m via share placement

VC has raised ТЃ61m across its EIS, VCT and secondary funds, giving it an additional total of ТЃ176m

Electra initiates sale process

LP is also exploring the potential sale of its entire portfolio or the sale of individual assets

Idinvest boosts growth capital team with new hire

Guillaume Santamaria joins as investment director in Idinvest's Growth Capital team

ESO Capital opens Frankfurt office

Team will initially comprise four investment professionals, who will invest in DACH-based SMEs

Apax France promotes four

GP promotes an HR & ESG director, a principal, an associate and a CIO

21 Centrale Partners hires Cathay's Chatain as principal

In her new role, Chatain will work on the sourcing and investment of 21 Centrale's portfolio

Ambienta appoints Gatti as CFO, promotes two to partners

Gatti, who joined Ambienta in 2012, has worked on the implementation of the firm's best practices

Silverfern expands Frankfurt presence, hires Aon Hewitt's Köpke

Köpke will be responsible for Silverfern's institutional investor relationships and fundraising

BC Partners launches real estate arm

StУЉphane Theuriau, former CEO of Altarea Cogedim, is hired as managing partner

Japan Post Bank targets $76.5bn alternatives portfolio

More than JPY 2tn ($18bn) of the portfolio will be allocated to private equity

Calpers formalises direct investment strategy

Largest US public pension plan announces the creation of a new entity to make direct investments

NorthEdge hires two new portfolio directors

Keven Parker has experience from 3i, while Andy Tupholme previously worked at Gresham

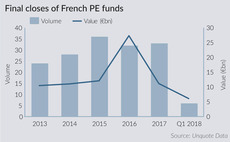

French fundraising on course for bumper year

Country has seen funds closing with a combined €6bn in commitments in Q1, more than half the total seen in 2017 as a whole

Turenne Capital announces raft of hires

French GP hires an investment director, two analysts and two chargés d'affaires

Alantra promotes Cowap and Robertson to directors

Cowap and Robertson joined the firm in 2013 as members of its UK advisory business