Industry

King & Wood Mallesons partner Brenner moves to Orrick

German lawyer Brenner and two associates will leave KWM for Orrick

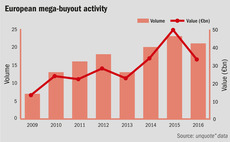

unquote" data snapshot: the five biggest buyouts of 2016

The year’s two largest deals, somewhat unusually, took place in Italy and Poland

In Profile: HIG Europe

GP has been particularly active in 2016, completing five exits and two buyouts, with two further deals in the pipeline

Altor faces DKK 1.2bn lawsuit over OW Bunker collapse

Curator of the Danish oil trading and supply company that failed in 2014 seeks damages

Mandarin hires two in Italy and Germany

GP boosts its Milan team with a new partner and new head of its German office

Benelux dealflow all but freezes over in H2

Despite a solid H1, deal volume plummets in second half of 2016, though average ticket size rises

GP Profile: Inflexion Private Equity

As part of our In Profile series, unquote" takes a look at the GP's busy 2016 and rapid-fire fundraises

Southern European activity fails to replicate 2015 surge

Italian private equity continues to dominate southern Europe, though the Iberian peninsula continues its recovery

In Profile: TDR Capital

GP launches its fourth vehicle, having successfully raised its annex fund earlier in 2016

Mega-deals cap good year in CEE

Region registers two €500m-plus deals in the final quarter of a strong year for private equity

Canopia Capital hires Quenardel for investment team

GP continues building its team following its name change from Corvm Capital in September

DACH buyouts on the rise throughout 2016

Despite low dealflow, the region saw an increase in buyouts during the course of the year, as aggregate value remained resolute

UK debt market rebounds in response to lower yields

Debt volumes were up 9% in Q3 2016 as lower yields prompt wave of recaps and refinancings

Clessidra holds €607.3m final close for third fund

GP has held a final close short of its initial €800m target, following a challenging fundraise

Investec unearths PE succession contradictions

Perceived importance placed on succession planning by GPs is not always mirrored by firms' approaches to transitioning control

Electra rebrands as Epiris as EPE split approaches

GP rebrands six months before its contract as EPE's investment portfolio manager terminates

French PE sees higher valuations in 2016 as dealflow drops

Increased competition and readily available debt lead to multiples creeping up in the country

Ex-Schroder exec O'Connor joins Unigestion as chair

Miles O’Connor has been appointed as chair of the board of Unigestion UK, based in London

In Profile: Vitruvian Partners

As part of our In Profile series, unquote" takes a look at the GP's recent activity and what lies ahead

NextStage launches IPO with plans to create evergreen fund

Investment firm hopes to reach an equity capital of €500m by the year 2020

Nordic outlook remains upbeat despite 2016 slowdown

Nordic private equity market saw overall deal value drop substantially in 2016

Omnes Capital targets international investors with partner hire

Omnes appoints Miria Späth Werder as partner and head of international business development activities

Political and economic uncertainty drives PE to UK staycations

Private equity players are increasingly looking to cash in on the shift in Britons' holiday habits

Demeter Partners merges with Emertec Gestion

Agreement follows Paris climate agreement COP21 and will see the firm branded as Demeter-Emertec