Benelux

Merieux Participations 4 holds €300m first close

MP4 provides equity tickets of тЌ20-80m, with a sweet spot of тЌ40-45m, targeting the health and nutrition sector

PE-backed IPOs on track for best year since 2017

This year has already seen 26 portfolio companies listing, with a total offering volume approaching тЌ12.7bn

RBS appoints new fund finance director in Luxembourg

Bank appoints Philip Prideaux to drive its Luxembourg funds banking offering

OpenGate heads for third fund launch targeting up to $700m

GP is currently investing its second fund, which held a final close on $585m in November 2019

Neuberger Berman launches ELTIF

Fund focuses on buyout opportunities blended with some growth and structured equity

Q1 Barometer: Total European deal value reaches new decade high

The latest Unquote Private Equity Barometer, produced in association with Aberdeen Standard Investments, is now available to download

Top Tier Capital closes European fund on €260m

Fund makes primary and secondary investments in venture capital funds and co-investments in select portfolio companies

Abingworth Clinical Co-Development Fund 2 closes on $582m

ACCD 2 finances the development of late-stage clinical programmes of pharmaceutical and biotechnology companies

ABN Amro backs ESG-linked facility for AlpInvest

Facility is for AlpInvest Co-Investment Fund VIII, with interest payments linked to ESG performance

Debt funds celebrate strong dealflow following Covid stress-test

Direct lenders now see shift away from refinancings and towards new deals, including 2020 processes coming back to life

Airbridge Investments contemplates new fundraise

Fund could tap family offices and wealthy individuals, while the VC's founders have so far invested their own capital

Park Square Capital Partners IV closes on €1.8bn

Fund invests in primary and secondary subordinated debt in both performing credit and dislocated debt

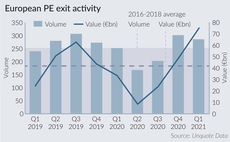

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Founders Circle closes third fund on $355m

Fund deploys flexible capital to meet the needs of growth-stage companies and support their expansion

Gimv buys minority stake in Projective Group

Digitalisation consultancy and recruitment business intends to pursue a buy-and-build strategy

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store

Tikehau's SPAC Pegasus raises €500m

Tikehau, FinanciУЈre Agache, Jean-Pierre Mustier and Diego De Giorgi commit to invest a total amount in excess of тЌ165m

Ares closes Ares Capital Europe V on €11bn

Ace V is Ares' largest institutional fund yet and is 70% larger than its тЌ6.5bn predecessor

MessageBird raises $800m series-C extension

The $1bn funding is reportedly Europe's largest ever series-C round

Endeit Capital holds final close for third fund on €250m

Fund II closed on тЌ125m in 2016; Fund III will continue to invest scale-up capital in European startups

Egeria acquires NIBC-backed Fletcher Hotels

NIBC backed Fletcher's 2016 MBO; Fletcher plans to grow from 103 to 150 hotels in the coming years

Prosus, Tencent lead $80m round for Bux

ABN Amro, Citius, Optiver and Endeit take part in the round, alongside previous backers HV Capital and Velocity

Digital Alpha Fund II closes on $1bn

Fund invests in digital assets, with a focus on next-gen networks, cloud computing and "smart cities"

Columbus Life Sciences Fund III closes on €120m

Fund invests in early-stage and high-growth opportunities across the life sciences and pharmaceutical industries