Benelux

Buying and building the modern school

Investments in European private schools and colleges have proven enriching for PE over the past two decades

LSP, Gimv et al. back iStar Medical €40m series-C

Series-C round will help Belgian medical device company to commercialise products

BNY Mellon expands PE capabilities

Robert Burchett-Coates and Greg Kok are appointed as directors based in London and Luxembourg, respectively

Main Capital sells Ymor to Sentia Group

GP sells Ymor, a Netherlands-based APM service, to Sentia Group after four years of ownership

Aurelius carves out YouBuild and MPRO

Carve-out of YouBuild and MPRO marks the maiden deal for Aurelius's Benelux team

Waterland buys Ad Ultima Group, Pylades

Waterland will bring the Belgian and Dutch business software specialists under a new group

Waterland buys majority in IE Group

Buyout sees Waterland appoint Thorsten Oelgart as the new CEO of Belgium-based IE Group

Volpi backs Mansystems with €20m

Volpi closed its debut fund on €185m, with the expectation of doing six platform investments

HPE Growth leads €35m series-B for WeTransfer

Existing investor Highland Europe has also taken part in the latest funding round

Triton opens office in Amsterdam, makes new hire

Triton has opened an office in the Netherlands and hired van de Linde from Bain Capital

Steadfast buys Koop Group

Fifth platform investment from Steadfast Capital Fund IV, which held a final close on €297m

Q2 Barometer: small-cap boom offsets mid-market lull

Europe records 533 buyout, expansion and early-stage investments over Q2, a nine-quarter low

Waterland eyes logistics companies Marinetrans, BGL

GP files with the regulator to buy Dutch logistics businesses Marinetrans and BGL

Sofina invests €150m in Drylock Technologies

Sofina buys a 25% stake in Drylock, a diapers and incontinence products specialist

Nordic region sees highest entry multiples for sixth quarter running

Q2 edition of the Clearwater International Multiples Heatmap finds a slight cooldown across Europe, though the average multiple still exceeds 10x

Waterland sells HistoGeneX to PE-backed Caprion Biosciences

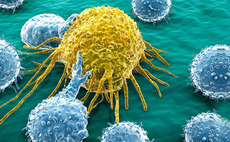

Waterland exits Belgium-based biotechnology business HistoGeneX to Canadian peer Caprion

GPs hungry for Benelux's food and beverages sector

From 2014 to date, Benelux has surpassed all other European regions in terms of large-cap buyouts in the food sector

Gimv's AgroSavfe receives €35m from investor consortium

Corporate Ackermans & van Haaren is backing AgroSavfe for the first time, injecting €10m

Gilde buys majority stake in Eichholtz

GP will help Dutch luxury furniture business Eichholtz to expand in the US and Asia

Perusa sells Xindao to Gilde

Perusa makes the divestment from Perusa Partners II, a €207m vehicle that closed in 2017

Equistone to acquire Heras

Equistone will acquire the property protection company from building materials group CRH

Steadfast, Kempen back Wilvo MBO

Kempen used its European Private Equity Fund, which held an interim close on €120m in June

Antea backs Frisse Blikken MBO

Deal is the sixth investment by the Antea Participaties VIII fund, which closed on €30m in 2017

Alcentra closes European direct lending fund on €5.5bn

Predecessor held a final close on тЌ4.3bn in 2017 and had an average ticket size of around тЌ100m