Benelux

3i hires four for private equity team

3i strengthens its US and European private equity teams with four new appointments

Alternative lending thrives in the Netherlands

Only the UK, France and Germany have seen more deals involving alternative debt, with Netherlands activity growing 31% year-on-year in 2017

Gimv strengthens presence in Munich

Philipp von Hammerstein has been promoted to partner in the GP's health and care division

John Holloway moves onto new role at EIF

Holloway will look after a new initiative involving fundraising from the private sector

Argos Soditic partner Semmens steps down

Development ends a 22-year spell at the firm, during which Semmens oversaw five fundraises

Walvis exits product information service Syndy to trade

VC firm sells its stake in the Dutch provider of product information to American company Icecat

LP direct investment: straight to the source

Limited partners are striking out on their own to source their investments directly, with numeorus new strategies emerging

Endless partially divests BAI to Shiloh Industries for €52.9m

GP has sold two of the automotive parts manufacturer's factories in the Netherlands and Italy

Large-cap deals drive strong start to 2018 for European PE

GPs deploy an extra тЌ7bn in aggregate value across European buyouts in the first two months of the year compared to 2017

Pantheon aims for FTSE 250 as NAV per share rises

Pantheon also announces a share restructuring and the issue of a ТЃ200m asset-linked note

Holland Ventures-backed Avensus buys ICT Visions

Security services and cloud technology service Avensus bolts-on Dutch ICT Visions

JC Flowers to list NIBC stake

Private equity firm will list 35% of outstanding and issued NIBC shares on Euronext Amsterdam

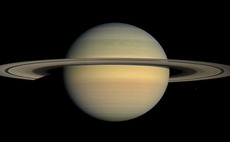

Hg launches Saturn fund

Naming convention follows Hg's Mercury series, which targeted the small-cap space

Vendis backs Kamera Express

GP buys a majority stake in Dutch photo and video equipment retailer Kamera Express in MBO

Statkraft leads €5m round for Parkbee

Fresh capital will be used to add 15 new full-time employees to the UK team

IK closes Small Cap II Fund on €550m hard-cap

Including a GP commitment of тЌ50m, the fund closed on its тЌ550m hard-cap on 15 February

Carlyle sells The Sniffers to trade

Sale ends a holding period of six years for Carlyle, which bought the company in December 2011

Nordic Capital acquires dental group

New group includes three dentist chains and a dental technology laboratory operator

Aquilo et al. invest $55.8m in Merus

Consortium of backers invests in the Dutch clinical-stage immuno-oncology company

Gilde sells Synbra to trade for €117.5m

Sale ends an 18-year holding period for Gilde, which acquired the company in 1999

European PE in 2017: Scaling new heights

Buyout activity and fundraising reached a new peak in 2017, with mega-buyouts and small-cap deals fueling dealflow and French funds popular among LPs

Vortex backs merger of Tritel and Fieber

Vortex drew equity for the transaction from Vortex Buyouts II, a €35m buyout vehicle

3i buys Royal Sanders from Egeria

Deal ends a three-year holding period for Egeria, which bought the company from Bencis

Q4 Barometer: Deal volume and aggregate value slide

Despite a boom in both dealflow and aggregate value across 2017 as a whole, the final quarter of the year saw a slowdown in activity