CEE

One third of LPs plan to increase PE allocation within a year – survey

Schroders' Institutional Investor Study surveyed 750 investors in February and March 2021

2021 European PE exits already exceeding full 2020 tally

GPs are clearly looking to seize the initiative and clear out portfolios amid a general push to ink deals on the buy-side

VC firm 212 to deploy EUR 32m in two years, gears up for exits

Sponsor has already deployed EUR 17m in 13 investments from its EUR 49m second fund

Social concerns increasingly important in European consumer M&A

Ethical supply chains, modern slavery, diversity and inclusion, wage gaps, and health and safety are all "potential liabilities" for M&A sponsors

European ESG market to hit EUR 1.2trn by 2025 – survey

Segment could account for between 27% and 42% of private markets' asset base, up from 15% in 2020, says PwC

Spotlight on Spacs: Fintech fever

A sustained surge in fintech deal-making may well have Spacs to thank

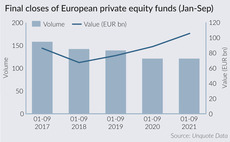

European GPs raise record amounts in first nine months of 2021

Raising EUR 105.5bn in aggregate commitments is a 30% increase on the average amount raised in comparable periods over the previous four years

Finberg to raise USD 25m for new IFR fund

Turkish corporate VC firm backed by Fibabanka and Fiba Group moves toward third-party funding

European buyout dealflow up 36% year-on-year in Q3

Europe was home to 346 buyouts worth an aggregate EUR 69.8bn in the third quarter, preliminary figures indicate

Women in PE continue to earn less than male counterparts – survey

Survey by Heidrick & Struggles found that female principals in the UK are an exception to the trend

European PE activity could reach EUR 400bn mark in 2021

Aggregate value for 2021 to date is already higher than that seen in any full-year on record, with a full quarter still to play out

Fund financing and ESG: from the impact niche to the mainstream

ESG-linked fund financing facilities are becoming a prominent т and well publicised т tool in the ESG toolbox for GPs and lenders

European IPOs reach seven-year high in first nine months of 2021

Sponsors have been on the ball when it comes to capitalising on the IPO window this year, according to Dealogic data

Revo Capital closes Fund II on EUR 90m

Fund held a first close on EUR 40m towards a target of EUR 60m in March 2020

3TS holds first close for Fund IV

Growth fund has a EUR 150m target and expects to announce its first investment shortly

Podcast: In conversation with… Adam Turtle, Rede Partners

Turtle joins the podcast to discuss the firm's journey over its first decade and the main trends in the European fundraising landscape

BlackPeak aiming to wrap up EUR 120m fundraise by year end

BlackPeak held a first close for the fund on EUR 68.5m in June, with a target of EUR 120m

Pictet holds USD 350m final close for Technology Fund

GP intends to launch a healthcare- and biotech-focused thematic fund in early 2022

Valuations rising as food & beverage whets PE's appetite

Within the space of a year, average pricing in the space has increased by 2.2 turns of EBITDA, research by Clearwater and Unquote shows

Livonia holds first close on EUR 147m

Fund was launched in 2020, with a hard-cap set at EUR 170m

Templeton PE on road for EUR 500m CEE-focused fund

Templeton Private Equity Partners will be looking to select a placement agent by the end of this year

DocPlanner raises round valuing business at USD 1bn

Another undisclosed round is expected within the next year, sources say

Lycian Capital aims to raise USD 100m, expects first close in Q4

Soft marketing kicked off in Q3, with Lycian currently receiving commitments from investors in Turkey

ZAS Ventures aims to raise USD 15m to invest in CEE startups

Soft marketing began in April 2021, with the launch taking place in June 2021