France

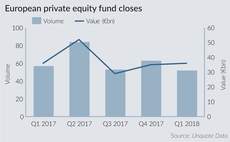

European fundraises off to healthy start in 2018

Number of fund closes and aggregate capital raised in Q1 is roughly on par with the same period last year, but short of the strong start to 2016

IK acquires controlling stake in Questel

Fresh capital will be used to support the company's international expansion

EdRip completes spinout from Edmond de Rothschild

Fully independent French firm with €2bn in AUM will operate under the name Andera Partners

Ontario Teachers' chief investment officer Graven Larsen resigns

Graven Larsen joined Ontario Teachers' in February 2016 and led the fund's global investment programme

Sofinnova holds €275m close for Crossover Fund 1

Vehicle will focus on biopharma and medical companies with EVs of €50-150m

Naxicap's Technicis bolts on TextMaster

Technicis acquires French online translation service TextMaster with debt from Idinvest

French VC fundraising shifts towards sector specialisation

A number of specialist VC funds have held first or final closes in recent months, bringing distinct advantages and risks in equal measure

PAI Europe VII closes on €5bn hard cap

PAI says it hits its hard-cap after only six months on the road, with a demand of more than €15bn

Carlyle's Comdata bolts on CCA International

Following the acquisition of CCAI, Comdata expects to reach revenues of around €1bn globally

Ciclad in talks to buy Bertin Ergonomie

French GP plans to wholly acquire ergonomics consultancy Bertin Ergonomie via Ciclad VI fund

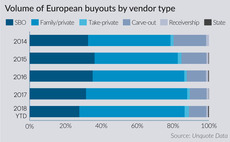

Secondary buyouts hit 10-year low in Q1

Proportion of deals sourced from fellow PE firms has ebbed back to the level last seen in 2007, according to Unquote Data

BlackFin Capital Partners exits Cyrus

Management team buys back the French wealth management advisory firm, with debt from Ardian

Ardian exits Brico Privé in SBO

Ardian sells its minority stake in the French online DIY and gardening retailer to a fellow institutional investor

Isatis backs Oriental Viandes

Senior debt for the transaction was provided by CIC Est, LCL and Banque Palatine

European entry multiples hit new high in 2017 despite Q4 cooldown

Average EBITDA multiple increased to 10.4x in 2017 compared with 10.2x in 2016, according to the latest Clearwater Multiples Heatmap

Capzanine promotes two in investment team

Clément Colin becomes principal and Emmanuel Fournial is promoted to senior associate

Entrepreneur Venture, Carvest back VM Constructions

Entrepreneur Venture and Crédit Agricole Régions Investissement inject €4.3m for a minority stake

Ardian sells Groupe Bio7 to trade

Buyer Cerba HealthCare is owned by Partners Group and Canadian pension fund PSP Investments

Sofinnova leads €6m series-A for SafeHeal

Fresh capital will be used to develop a clinical and regulatory market access programme for Colovac

Mega-buyout volumes hit post-crisis Q1 high

Combined with Q4 2017, the past six months have represented the most active consecutive quarters for тЌ1bn-plus buyouts since 2007

Gide hires Skadden's Diaz

Diaz will oversee and lead the commission in charge of exploring growth possibilities

Naxicap enters exclusive negotiations to buy ECS

GP is in talks to buy French outsourced airfreight operations service ECS from Alpha

Omnes launches new funds

Omnes Real Tech, Omnes Expansion III amd Mezzanis III expected to hold closes in 2018

Seventure holds first close on €24m

France-based animal nutrition specialist Adisseo is among Seventure's AVF fund investors