Nordics

PE-backed Helgstrand Dressage merges with Ludger Beerbaum Stables

Waterland-backed Danish company Helgstrand Dressage has acquired and merged with equestrian show jumping business Ludger Beerbaum Stables.

Full In Partners acquires Danish firm Cybot

Deal value was reportedly 10 times the company's turnover of around тЌ13.4m

Litorina, Bragnum back Nordic Surface Group

Litorina and Bragnum Invest will be co-owners alongside the management and local entrepreneurs, who remain significant co-owners

Element Ventures leads €15.5m funding for fintech Minna

New funding takes the total the company has raised so far to тЌ23m

EQT Ventures leads $18m round for Sana Labs

Latest round brings its total funding so far to $23m, having previously raised $4m in 2018 and $1m in 2017

AMF leads €52m series-C round for Budbee

Latest round brings Budbee's total funding to date to тЌ92m

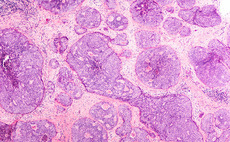

LSP launches €150m fund dedicated to dementia treatment

Vehicle invests in companies that are developing drugs for neurodegenerative diseases

eEquity, Bonnier Ventures sell Refunder to trade

eEquity exits the company three years after acquiring a majority stake in the company, and achieved a multiple of 3-5x on the transaction

HBM Healthcare leads €127m series-B for IO Biotech

Funding follows the US Food and Drug Administration granting the company breakthrough therapy designation for its lead programmes

Alder sells Nordic Water to trade

Swiss buyer is paying тЌ119m for the company and will see Alder and the management exit the business

Marlin and Francisco to merge Unifaun and Consignor

GPs will be equal shareholders in the combined business and own a majority stake in the company

CVC Capital Partners buys Stark Group from Lone Star

GP paid around тЌ2.5bn for the company, deploying equity from CVC Capital Partners VII

EQT, Verdane to merge Confirmit and FocusVision

Combined company will be led by Confirmit CEO Kyle Ferguson and supported by management of both companies

Covid-19 impact expected to be more severe than GFC – survey

Almost all Dechert survey respondents expect distressed deals to increase, while 82% cited more deal delays as an ongoing effect

Adelis buys stake in Finnish digital learning firm Valamis

Current management will retain a significant stake in the company and continue in their roles

Here's to a merrier 2021

The Unquote team wishes you a restful break and will be back to cover European private equity news on 4 January

Unquote Private Equity Podcast: Nordic 2020 Review

Katharine Hidalgo welcomes Unquote Nordic reporter Eliza Punshi to discuss how dealflow and fundraising prospects are faring as 2021 rolls on

MB Funds to sell A-Katsastus to Finnish cooperative Tradeka

Exit comes a year and a half after the Finnish GP acquired the company from Bridgepoint, having also owned the company between 2003 and 2006

Maj Invest acquires Ferm Living from Vendis Capital

Deal reportedly values the interior design company at around тЌ67m

Hg acquires Geomatikk

GP is deploying from its Hg Mercury 2 Fund, which held a final close on ТЃ575m in February 2017

Sanofi et al. back €47m series-B for MinervaX

MinervaX has so far raised a total of $81.5m in funding, including grants

AlpInvest closes seventh secondaries fund on $9bn

ASP VII is a dedicated secondaries investment programme focused on fund interests and GP-centered investments

Procuritas buys and merges Medpro and Omtanken

GP is deploying equity from Procuritas VI, which held a final close on тЌ318m in May 2017

FSN to acquire 45% stake in Obton

GP is reportedly paying тЌ403m for its stake, corresponding to a valuation of 25x profit for 2019