Nordics

VC-backed Spacemaker sold to Autodesk for $240m

Deal comes a year and a half after the startup raised a $25m series-A round co-led by Northzone and Atomico in June 2019

EQT-backed HusCompagniet prices IPO

Company's IPO had reportedly been covered on the first day of the bookbuild

Bridgepoint-backed Diaverum to launch IPO

Planned IPO could reportedly value at the renal care clinics group at more than тЌ2bn

Nordic Fundraising Pipeline - Q4 2020

Unquote compiles a round up of the most notable fundraises ongoing across the Nordic market

Eight Roads, Balderton lead $30m series-B round for Tibber

Alongside equity, the company secured $35m in debt financing from Nordea

Nordic Capital-backed Nordnet prices IPO

Offer amounts to roughly 38% of the total number of shares being offered in the company

PE-backed Nets and Nexi sign agreement for merger

Deal values the Danish paytech company at тЌ7.8bn

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Main Capital buys Sweden's Pointsharp

GP will pursue a combination of organic growth and acquisitions in the Nordics, Benelux and DACH

Second-round bids due next months for Kotkamills - report

Triton Partners is one of the GPs vying for the company, according to Mergermarket

Innovestor leads €1.1m seed round for Linear

Startup will use the proceeds for future growth and expansion to new markets

Speedinvest holds first close for Speedinvest x Fund 2

VC also announced the appointment of Tier Mobilty co-founder Julian Blessin as partner

Via Equity invests in ESmiley

Deal is the GP's first from its fourth fund, which held a first close last month and is targeting тЌ175m

MIG leads €39m series-A round for IQM

"Deep tech" startup has so far raised тЌ71m since being founded in 2018

EQT Growth's bet on maturing European startups

New growth investor plans to announce at least one deal by the end of the year, says partner Carolina Brochado

Bridgepoint buys minority stake in Diagnostiskt Centrum Hud

GP will help the company's expansion further into the Nordic region

Värde Dislocation Fund closes on $1.6bn

Fund has a global mandate to pursue a mispriced, stressed and distressed credit

EQT sells Tia Technology to trade

GP is selling the company for $78m in cash on a fully diluted basis, six years after acquiring it

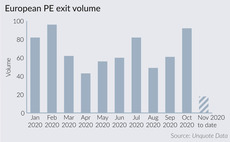

Private equity ramps up divestment efforts

Exit activity jumped by 50% in October, back to pre-pandemic levels, according to Unquote Data

Eurazeo Brands buys majority stake in Axel Arigato

GP will own the company alongside its founders, Max SvУЄrdh and Albin Johansson

Bertel O Steen Kapital buys partial stake in ITVerket

Computer services company expects to generate a turnover of NOK 170m (тЌ15.6m) in 2020

Riverside sells Swedish Education Group for €18m

GP exits the business nine years after acquiring it via its 2008 fund Riverside Europe Fund IV

Buyout rankings: who has invested most across Europe since April?

EQT, Ardian and KKR remained very active and struck sizeable deals amid the coronavirus turmoil

MVI buys Swedish company Biototal

Deal is the second investment from the GP's MVI Fund II, which is still on the road and is targeting SEK 1bn