Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Mobeus invests further £3.2m in Motorclean

Mobeus Equity Partners has provided an additional ТЃ3.2m to Motorclean, the specialist car valeting business acquired by the GP in 2011.

Inkef invests €7.5m in Sapiens

Inkef Capital has invested €7.5m in Dutch medical technology company Sapiens Steering Brain Stimulation (Sapiens), extending the company's series-A funding.

Elbrus buys OSG Records Management from Aurora Russia

Elbrus Capital has acquired Russian storage and records company OSG Records Management from Russian investment company Aurora Russia.

Spanish government attempts to boost alternative funding for SMEs

The Spanish government has announced its intention to facilitate investment in SMEs at a press conference after the Council of Ministers meeting, say reports in the local press.

Equistone to buy Meilleurtaux

Equistone has entered into exclusive negotiations with French banking group BPCE regarding the sale of real estate mortgage adviser Meilleurtaux.

CVC places Evonik shares as IPO markets wake up

CVC is the latest GP taking a more flexible approach to exiting its businesses, selling a share in chemicals business Evonik to institutional investors in preparation for an IPO.

Amadeus Capital Partners backs Bellco

Amadeus Capital Partners has entered the shareholding of Italian dialysis technology company Bellco, owned by Montezemolo & Partners.

Litorina et al. invest in Kontorsvaruhuset Gullbergs merger

Litorina Capital Partners has backed a merger to form the new group Kontorsvaruhuset Gullbergs, a Swedish supplier of office wares and related services.

Connection Capital and Riverside buy the Cresta Court Hotel

Connection Capital and Riverside Capital have teamed up to acquire the Cresta Court Hotel in Altrincham and its operating company Harrop Hotels in a ТЃ2.95m MBI.

Nordic Capital's eighth fund holds first close

Nordic Capital has held a first close on тЌ1.7bn for its latest fund, exceeding its expected тЌ1.5bn first-close target.

3i sells Enterprise in £385m deal

3i has sold business services provider Enterprise to Spanish infrastructure company Ferrovial for ТЃ385m.

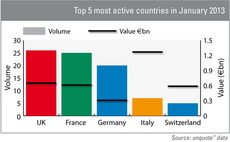

Italy shines in January thanks to CVC mega-buyout

Italy topped Europe's private equity value charts in January, while the UK recorded the most deals, showing both familiar names and outliers starting 2013 on a high.

Sun European Partners sells $72m Lee Cooper Jeans to Iconix

Sun European Partners has sold British apparel brand Lee Cooper Jeans to Iconix Brand Group for $72m.

Private equity-backed Eco Eridania bolts on three

Waste management firm Eco Eridania, backed by Fondo Italiano di Investimento, has acquired three companies: Paderno Energia, Elettrochimica Carrara and Technoplus, the waste management arm of Ghi.be.ca.

HTGF, Bayern Kapital et al. back crealytics

High-Tech Gründerfonds (HTGF), Bayern Kapital, LBBW Venture Capital, Mountain Super Angel and new investor BayBG have backed German technology business crealytics with a fresh round of funding.

CDC Entreprises et al. invest €7m in Compario

CDC Entreprises, Capitalaria, iSource Gestion and XAnge Private Equity have participated in a €7m funding round for French software-as-a-service (SaaS) firm Compario.

Austrian private equity market gathers momentum

Austria’s private equity scene could be on the verge of a mini-boom as January’s deal activity has already outperformed last year’s first quarter.

Isai invests €2m in Hospimedia

Isai Gestion has injected €2m into French medical information website Hospimedia, in what marks the first investment from its latest fund.

CapMan Buyout appoints Johnson as partner

Nordic mid-market private equity investor CapMan Buyout has appointed Dan Johnson as a partner in its Stockholm office.

KKR to sell BMG stake to Bertelsmann

KKR is reportedly about to sell its 51% stake in joint music venture BMG to co-owner Bertelsmann.

Enterprise Investors injects €2.2m into EP Serwis

Enterprise Investors has completed a €2.2m financing round for Polish pallet services company EP Serwis.

Argos Soditic to buy four Sage subsidiaries

Mid-cap GP Argos Soditic has entered exclusive negotiations with Sage Group regarding the acquisition of four of its software-focused subsidiaries in France and Spain.

Ratos made SEK 363m loss in Q4

Ratos made a net loss of SEK 363m in the fourth quarter of 2012 and expects the downwards trend to continue during the first half of 2013.

Ista sale to kickstart German large-cap activity

Charterhouse and CVC Capital Partners are expected to launch exit proceedings for German energy-metering firm Ista, amid speculation that German deal values could surge in the coming year.