Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

XAnge and Astutia invest in Pactas

XAnge Private Equity and Astutia Ventures have invested in German e-invoicing specialist Pactas.

Apollo negotiates stake in Aurum Holdings

Apollo Global Management has shown interest in acquiring a stake in British jewellery company Aurum Holdings, according to The Telegraph.

XAnge and Siparex back La Ruche qui dit Oui!

XAnge Private Equity and Solid, a social enterprise fund managed by Siparex, have invested €1.5m in French marketplace La Ruche qui dit Oui!

Innova and EBRD invest in EnergoBit

Innova Capital and the European Bank for Reconstruction and Development (EBRD) have taken over Romanian electrical engineering services company (ESCo) EnergoBit.

BlackFin acquires minority stake in Groupe Cyrus

BlackFin Capital Partners has taken a minority stake in the MBO of French wealth management firm Groupe Cyrus.

Investindustrial bids for Aston Martin

Italian GP Investindustrial has made an offer to acquire 50% of luxury sports car designer and manufacturer Aston Martin, according to reports.

French deal volume at 14-year low

French investment volumes in 2012 are set to be the lowest seen in the country for over a decade, according to the latest figures from unquote” data.

Eaton joins Goodwin Procter London office

US law firm Goodwin Procter has appointed Ben Eaton as a partner in the firmтs London office. Eaton joins from a tax counsel position at Allen & Overy.

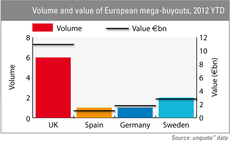

UK mega-buyouts worth more than €10bn this year

In defiance of problems on the continent, the UK has seen a surge in mega-buyouts this year, topped off with the recent acquisition of Annington Homes for ТЃ3.2bn.

Blue Sea Capital acquires Dom Zdavlja Dr Ristic

Blue Sea Capital has acquired Serbian private healthcare clinic Dom Zdravlja Dr Ristic.

Highlander buys ProService AT from Enterprise Investors

Highlander Partners has acquired Polish transfer agent ProService Agent Transferowy from Skarbiec Holding, a portfolio company of Enterprise Investors.

Elbrus Capital invests in SPSR-Express

Elbrus Capital has taken a stake in Russian delivery business SPSR-Express, leading to a partial exit of the Russian Retail Growth Fund.

HTGF et al. back InnoCyte

High-Tech Gründerfonds (HTGF), the Mittelständische Beteiligungsgesellschaft (MBG) and Fraunhofer Venture have invested a six-figure sum in German medical device company InnoCyte.

H2 Equity Partners supports MBO of Hancocks

H2 Equity Partners has acquired British confectionery wholesaler Hancocks Group Holdings, alongside the company's management.

French deal volume at 14-year low

French investment volumes in 2012 are set to be the lowest seen in the country for over a decade, according to the latest figures from unquote” data.

NVM exits Paladin Group

NVM Private Equity has exited its stake in UK-based property services company Paladin Group to trade player Places for People in a deal worth ТЃ15.9m, reaping a 2.3x return on its investment.

Principia et al. invest in Eco4Cloud

Principia and dpixel have invested €300,000, with a further €2m investment guaranteed, in Italian energy saving technology developer Eco4Cloud, according to reports.

Piaseki becomes principal in Silverfleet promotions

Silverfleet Capital has promoted three members of its investment team in London and Paris.

Herkules Capital's Pronova BioPharma receives takeover bid

Herkules Capital's Norwegian portfolio company Pronova BioPharma has received a voluntary cash offer from German chemicals company BASF SE.

Italian GPs circle Pirelli

Clessidra and Investindustrial are in exclusive talks over the holding company that indirectly controls Italian tyre manufacturer Pirelli.

Warburg Pincus-backed Premier Foods to cut 900 jobs

Warburg Pincus portfolio company Premier Foods has announced plans to shut down two bakery sites in Greenford and Birmingham next year, in addition to the previously announced closure of its Eastleigh bakery. The decision will result in 900 job losses...

NVM backs Haystack Dryers

NVM Private Equity has invested ТЃ3.5m in UK-based manufacturer of body dryers Haystack Dryers.

21 Partners' Almaviva Sante acquires two French clinics

Almaviva Sante, portfolio company of 21 Partners, has acquired French private healthcare clinics Axium and Clinique Toutes Aures.

Longwall Ventures launches £40m tech fund

Longwall Ventures has launched its second fund, Longwall Ventures Enterprise Capital Fund (ECF), targeting ТЃ40m for investments in UK science and technology companies.