Sector

CVC's Hellenic Healthcare to buy Hygeia

Following the deal, MIG will have the right to acquire a stake of up to 10% in Hellenic Healthcare

Activa, BPI France invest in Active Assurances

Following the deal, the new investors will join the founding shareholders in Active Assurances

Keensight, Eres acquire Biovian

Keensight and Edmond de Rothschild Equity Strategies funds buy the Finnish CDMO

Terra Firma mandates Christie & Co for Wyevale sale

GP has secured a 12-month extension to its 2007-vintage fund to enable the sale of remaining assets

Main Capital acquires stake in SDB Ayton

SDB Ayton intends to grow its business through a buy-and-build strategy following the deal

NorthEdge's Direct Healthcare Group bolts on Qbitus

Following this last acquisition, Direct Healthcare expects to reach a turnover of ТЃ24m in 2018

Project A backs €6m funding round for Keatz

Fresh capital will be used to open new kitchens in Frankfurt, Munich, Milan, Amsterdam and Paris

Ginko leads $100m round for HMD Global

HMD Global plans on making strategic investments and scaling up business operations

Sovereign reaps 8x on sale of Kindertons to ExamWorks

Sale of the UK-based accident management business was based on EBITDA of around ТЃ20m

Riverside backs GermanPersonnel

Riverside will support GermanPersonnel's expansion by bringing in industry experts

Foresight injects £3m into DA Languages

UK interpreting and translation business will look to expand its private sector activity

BC Partners launches real estate arm

StУЉphane Theuriau, former CEO of Altarea Cogedim, is hired as managing partner

Edge leads £4m Hoop series-A

Deal will enable the online booking platform to expand its operations team and prepare for a US launch

PAI acquires M Group from First Reserve

Acquirer is currently investing from its sixth flagship fund, which writes equity cheques of тЌ100-300m

Montefiore backs Groupe Premium

GP buys a 70% stake in insurance business Groupe Premium via Montefiore Investment IV

BGF invests £3m in Ruroc

Company will use the fresh capital to support the launch of its new Atlas motorcycle helmet

Permira sells remaining Just Group shares

Final selldown follows GP's share sale in January, in which the investor sold shares worth ТЃ78.5m

Investindustrial hits €375m hard-cap for smaller fund

Fund targets lower-mid-market companies with strong internationalisation potential

Lone Star backs €1bn carve-out of Imerys tiles division

Deal, the GP's third since 2016 in the building materials sector, is valued at 9x EBITDA

Lone Star's Evoca bolts on Quality Espresso

Following the acquisition, Evoca plans to expand further in the APAC region and in North America

Paragon buys Inprotec

Selling shareholders Andreas Baranyai and Pierre Schwedtfeger will retain a significant minority

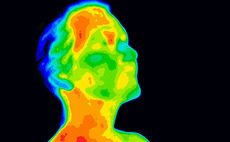

Carlyle in exclusivity for HGH Infrared Systems

GP is to draw equity from its €656m European technology fund to acquire the infrared systems company

BaltCap exits Runway to KKR-backed Webhelp

Deal also sees the current majority shareholder Dasha sell its shares to Webhelp

IK backs Domia Group in SBO

Sale ends a five-year holding period for Metric, which bought the company in May 2013