Sector

Oxy Capital backs GPack

Deal includes the restructuring of around €60m in debt and the injection of fresh funds, as well as managerial support

Screen Capital buys machine rental firm Tätab Hyrservice

Deal is in line with a generational change in ownership of TУЄtab, which was established in 1963

CVC sells AR Packaging to trade for $1.45bn

CVC Capital Partners has signed an agreement to sell portfolio company AR Packaging Group to listed company Graphic Packaging Holding Company for $1.45bn.

Neuberger exits Service Med to MedicAir

GP sells its 75% stake in the medical company, controlled via Atlante Private Equity Fund

Digital+ Partners gears up for fundraise

GP focuses on later-stage B2B technology companies and closed its previous fund in 2018 on €350m

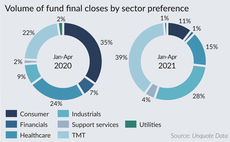

PE funds raised in pandemic increasingly target TMT opportunities

GPs' origination preferences and 2020 investment volume have already shown a clear shift to technology investments, with new fundraises following suit

Raise, IDI buy PE-backed Talis Education

Azulis Capital and Aquiti Gestion invested in the professional training provider in January 2020

Sentica exits Finnish IT company Solteq

Exit comes 11 years after the GP, via Sentica Buyout III, invested in Descom, which was acquired by Solteq in 2015

Abénex backs medical imaging software provider EDL

GP plans to support the company in boosting its organic growth and accelerating its expansion through targeted add-ons

Bain's Parts Holding Europe files for IPO

PE-backed IPOs have been scarce in France in the past five years, according to Unquote Data

Bluefront Equity acquires Norwegian firm Redox

GP is acquiring a 51.8% stake in the company, alongside its management, according to Finansavisen

FSN acquires Omegapoint from Priveq

Priveq exits the company four years after acquiring a 40% stake

Chequers Capital to carve out Corning Services

GP plans to assist the telecommunications service with a buy-and-build strategy

Eurazeo invests in I-Tracing in €165m deal, Keensight exits

Following the deal, Sagard NewGen invests as a minority shareholder in a holding company controlled by Eurazeo

Hg-backed MeinAuto postpones IPO

Car sales platform cited "currently adverse conditions for high-growth companies" in a statement

EQT Growth leads €250m series-F round for Vinted

Latest round brings the total amount Vinted has raised to nearly €500m

HIG acquires majority stake in Infratech Bau

GP intends to support the infrastructure project contractor through organic and acquisitive growth

Altor acquires Swedish home appliance maker Aarke

Company has grown rapidly in the last few years, with sales exceeding SEK 200m in 2020, up from SEK 85m in 2019

Keensight sells LinkByNet to Accenture

Deal ends a five-year holding period for Keensight, which invested €50m in LinkByNet in exchange for a minority stake

Polaris backs sportswear retailer Stronger

GP is acquiring a 51% in the company, with the remainder retained by the founders and management

Paragon's Apontis Pharma completes IPO

GP acquired the single-pill producer in a carve-out in 2018 and will retain a 31% stake

UI Investissement, Geneo back clinic operator GBNA

UI and Geneo invest in the company via a capital increase, partnering with the Guichard family

Neo Investment exits restaurant chain Obicà

Sale ends a nine-year holding period for Neo Investments, which acquired a 52% stake in Obicà from the company's founders

Abingworth Clinical Co-Development Fund 2 closes on $582m

ACCD 2 finances the development of late-stage clinical programmes of pharmaceutical and biotechnology companies