Unquote

Bridgepoint Europe VII in final stretch of EUR 7bn fundraise

GP’s latest flagship fund held a EUR 4bn close in mid-May, with a final close expected in H1 2023

StepStone Group gears up for next Tactical Growth Fund

Predecessor primary, secondaries and co-investment vehicle held a final close in 2021 on USD 690m

Triton reaps 4x gross money in Ewellix trade sale

Valued at EUR 582m, deal for industrial tech group marks first exit by Triton V

LGT closes third co-investment fund on USD 2bn

Crown Co-investment Opportunities III held final close USD 500m above target

Pemberton strengthens team with four senior hires

Anders Svenningsen, Christoph Polomsky, James Taylor and Sally Tankard join the firmтs European offices

Cinven plays long game with financials fund in hunt for 3x returns

With a life of 15 years, the new vehicle has closed above target, with insurers making up about a quarter of its LP base

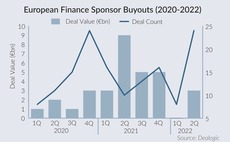

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

Optimism prevails as PEs expect step-up in deal-making – research

Third Bridge's Joshua Maxey speaks to Unquote about the findings of the Mid-market PE Forecast: 2022

The Bolt-Ons Digest – 13 July 2022

Unquote’s selection of the latest add-ons with Ardian's Aire, Kester's Rephine, Arta/KKR's Alvic, Capiton's Dec Group, and more

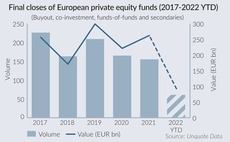

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

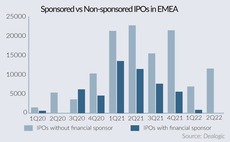

Corporates best placed for autumn IPO window as sponsors sit out

GPs expected to continue to ditch listings in the short term in favour of sale exits, longer holding periods

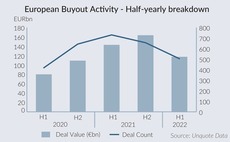

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

William Blair poaches peers in European advisory boost

Five senior hires announced across technology, services, industrials, and debt advisory teams

Women lead push for diversity in PE, M&A

Supporting diverse hires and leadership, as well as opening up networks, remain key

Bain Capital, Nextalia to acquire Deltatre from Bruin Sports Capital

Italian sports technology provider first sale attempt was hampered by the onset of COVID-19 in early 2020

Riverside appoints Höppner as chief sustainability officer

Dörte Höppner joined the GP in 2017 and will be responsible for its ESG initiatives globally

Titanbay launches co-investment programme

Private markets platform plans to make 10-12 deals per year and has a live opportunity in Germany

Record number of LPs to cut "new money" commitments – Rede Partners

Biannual LP sentiment survey also reveals that LPs are expecting a drop in distributions

The Bolts-Ons Digest – 17 June 2022

Unquote’s selection of the latest add-ons with Holland's AMP, Triton's Kinios, Nordic's Sortera, Vitruvian's Sykes, and more

Clearwater Multiples Heatmap: PE activity holds up amid war, inflation woes

Record levels of dry powder continue to bolster the resilience of the buyout market in Q1 2022

Family offices raise stakes in private equity – UBS

High inflation, rising interest rates leading wealthy families to review investment options, says report

LPs' net returns highest since financial crisis – Coller Capital

Secondaries specialistтs Summer 2022 Barometer shows that half of LPs want to increase their allocation to alternatives, with 91% still committing to PE first closes with incentives

Five Arrows kicks off Laf Santé sale

Five Arrows has owned a majority stake in the France-based low-cost pharmacy chain since 2016

Pantheon, ICG appoint new ESG heads

Eimear Palmer joins Pantheon from ICG, which has poached Elsa Palanza from Barclays