Exclusive

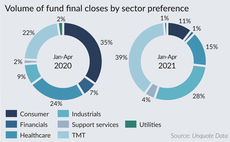

PE funds raised in pandemic increasingly target TMT opportunities

GPs' origination preferences and 2020 investment volume have already shown a clear shift to technology investments, with new fundraises following suit

Livingbridge reaches £1.2bn mark for seventh fund

Partner Fiona Dane recaps the fundraising effort, which is double the size of its predecessor, with Harriet Matthews

Eurazeo launches PME IV Fund

Eurazeo's PME arm deploys equity tickets of €20-100m, focusing on French mid-market businesses with EV of €50-200m

Taaleri prepares bioindustry-focused fund launch

Fund will typically invest тЌ5-25m and will look at both majority and minority situations

EQT sells StormGeo to Alfa Laval in €363m deal

Deal gives the company an enterprise value of NOK 3.6bn (тЌ363m), which is 17.7x its 2020 EBITDA

Investec provides ESG-linked NAV facility for Bluewater

Facility is related to the portfolio of Bluewater Energy Fund I, which closed in 2013 on $861m

Debt funds celebrate strong dealflow following Covid stress-test

Direct lenders now see shift away from refinancings and towards new deals, including 2020 processes coming back to life

Airbridge Investments contemplates new fundraise

Fund could tap family offices and wealthy individuals, while the VC's founders have so far invested their own capital

YielCo holds closes for PE and co-investment funds

YielCo Special Situations Europe II is targeting тЌ300m; YielCo Defensive Investments targets тЌ150m

Andera Partners lines up DACH expansion plans

Starting with BioDiscovery 6, the GP intends to accelerate fundraising and deal-making in the region

Xenon closes small-cap fund on €85m

Xenon Small Cap Fund is dedicated to investments in Italian companies generating EBITDA of up to €3m

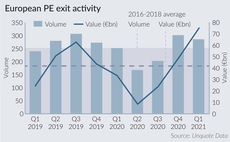

European PE exits back to historic highs in Q1

Greater visibility on the pandemic's impact, attractive comparables and PE's strong appetite on the buy-side embolden managers

Gyrus holds close for Gyrus Investment Program

Program comprises Gyrus Principal Fund and its co-investment Cortex fund; it has a тЌ400m hard-cap

GP Profile: Quadrivio plots busy investment schedule for 2021

Quadrivio co-founding partner and CEO Walter Ricciotti discusses the firm's latest fundraises, portfolio performance and upcoming investment pipeline

Fundraising fortunes: prevailing LP preferences persist

Alessia Argentieri looks at the winning strategies, and gathers insight from placement specialists as to what the rest of 2021 has in store

FlyCap targets €25-35m for mezzanine fund

Latvian government's development finance institution Altum commits around 60% of the fund

Endeit Capital holds final close for third fund on €250m

Fund II closed on тЌ125m in 2016; Fund III will continue to invest scale-up capital in European startups

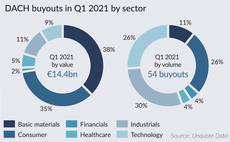

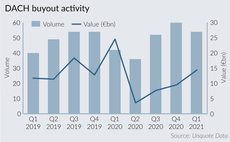

Appetite for DACH tech deals continues apace in Q1

Sponsor demand for differentiated IT services and roll-up strategies remains consistent

LeadBlock plans €100m second close for blockchain fund

Fund held a first close on тЌ10m in March this year and will invest at the seed and series-A stages

LP Profile: PFR increasingly eyeing funds outside Poland

Polish LP has invested €75m in four private equity firms in recent months, including Apax Partners, PAI Partners and Avallon MBO

DevCo acquires minority stake in Bluefors

GP is deploying equity from DevCo Partners III, which raised тЌ180m at the end of 2019

DACH buyouts continue recovery from Q2 2020 low

Both deal volume and value are now back on par with the figures for Q4 2019, prior to the pandemic

Endeavour Vision closes Medtech Growth II on $375m

Fund is 30% larger than its predecessor and will continue to focus on medtech growth investments

Primo Digital Fund launches with €80m target

Fund has a special focus on the e-commerce, software, cybersecurity, fintech and blockchain sectors