Market Insight

Mapping out value with the Multiples Heatmap

Our exclusive report uncovers the regions and sectors offering the best value

Comment: Redefining the off-market deal

Grant Thornton's Gray discusses off-market deals to conclude our Origination Series

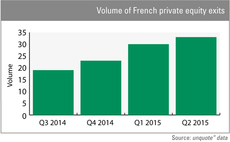

French exit activity continues rebound in Q2

GPs across Europe continue to take advantage of seller's market

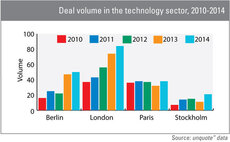

Tech Cities: European capitals house growing number of tech deals

From Paris to Berlin, European capital cities see uptick in tech deals

Holding periods shorten as divestment activity ramps up

Private equity houses are taking advantage of the strong exit market

Turnarounds still struggling to take off

Turnaround deals throughout Europe remain at low levels

Market Insight: UK consumer sector refinancings

A detailed look at trends in the refinancing market

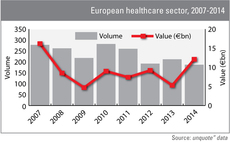

Care providers attract increasing share of PE healthcare deals

Overall healthcare deals are falling, but healthcare provider sub-segment is thriving

Q1 Barometer: deal volume and value decline

The European buyout market witnessed a fall in both deal volume and value for Q1

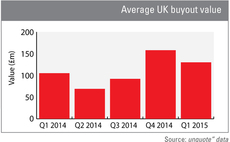

Average UK buyout value up 24% year-on-year

Q1 2015 average value down on Q4 2014 spike, however

French portfolio companies survey highlights challenges ahead

New research digs into portfolio company managers expectations for the year ahead

Germany, UK drove 10% activity uptick in Q4 2014

Fourth quarter witnessed an encouraging rise in deal volume and value

European venture's reliance on public funding

Exclusive research reveals venture funds' over-reliance on public funding

Q3 Barometer: Mid-market proves resilient

Overall European buyout activity declined, but Q3 figures highlight mid-market's resilience

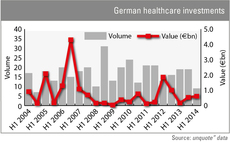

German healthcare deals on the decline

Healthcare deals in Germany have dipped, highlighting difficulties in the space

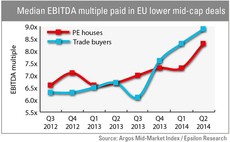

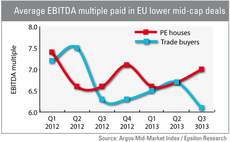

Lower mid-cap valuations near 2006 levels

PE houses catch up with corporates as lower mid-market heats up

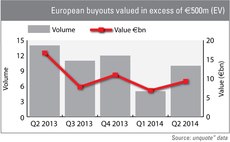

Large-cap activity gaining momentum in Q2

Welcome uptick at larger end of market, both for new deals and exits

UK Watch: Q1 deal volume drops off

But increased exit activity is buoying the market

Q1 Barometer: primary buyouts stand out

Overall buyouts down by 10% in lacklustre quarter

Q4 Barometer: dealflow bounces back

Following a weak Q3, the final months of 2013 marked the strongest quarter of the year, according to the latest unquoteт Private Equity Barometer, published in association with SL Capital Partners.

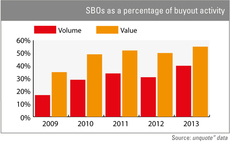

SBOs hit new peak in 2013

Secondary buyouts rose to new levels of prominence in the European market last year, accounting for 40% of all buyouts and 55% of aggregate buyout value. Greg Gille reports

2013 buyouts: overall value stabilises around €75bn

The overall value of European private equity-backed buyouts has hovered around the тЌ75bn mark for the third year in a row, with last year's deals totalling тЌ74.7bn.

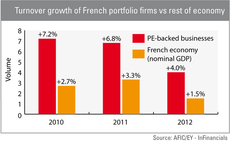

French PE-backed firms outperformed rest of economy in 2012

French private equity-backed companies significantly outperformed their peers in terms of job creation and turnover growth in 2012, according to a new survey by Afic and EY.

Lower mid-cap uptick bolsters valuations

Private equity buyers have been more bullish than their corporate counterparts on pricing in the third quarter, according to the latest Argos Mid-Market Index. Greg Gille reports