OMERS

The Bolt-Ons Digest – 26 January 2023

Unquoteтs selection of the latest add-ons, with ICG's Circet, Five Arrows' Mintec, Carlyle's Jagex, and more

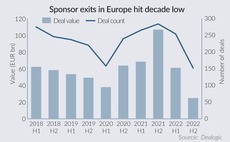

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

EQT Infrastructure in exclusivity to buy Trescal

OMERS Private Equity to retain 25% stake in the French calibration laboratories provider

ECI sells Bionic to Omers reaping 4.8x

Following the sale of the UK-based SME price comparison platform, ECI will reinvest via ECI 10

Omers' Trescal to hit auction block in H2 2022

DC advisory will guide the French calibration services specialist in its upcoming sale

Perwyn appoints investment manager from Omers

Maxime Menu joins from Omers Private Equity, where he worked as a senior associate

Inflexion hires Pagnotta as partner

Isabelle Pagnotta joins from her previous role as managing director at Omers Private Equity

AP Funds, Omers et al. in $2.75bn round for Northvolt

Battery maker has now raised more than $6.5bn in equity and debt, and will use the funding to expand its production capacity

Target Global leads $650m round for Wefox

Round is the largest ever raised in the European insurtech sector, according to Unquote Data

Omers buys into Partners Group's International Schools Partnership

Deal gives the international group of K-12 schools an enterprise value of тЌ1.9bn

KKR buys majority stake in ERM from Omers, AIMCo

Omers Private Equity backed the sustainability consultancy in 2015; the exit is valued at $2.85bn

OTPP, KKR to buy Caruna from First Sentier Investors, Omers

Following deal completion, KKR and Ontario Teachers' will each own 40% in the company, followed by AMF Pension with 12.5%, and Elo Mutual Pension Insurance Company with 7.5%.

Omers leads $20m round for Ultimate.ai

New investor Felicis Ventures also backed the round for the customer service automation software

Livingbridge sells Up Group to Omers-backed Alexander Mann

Livingbridge has invested in several recruitment businesses, including Armstrong Craven and Staffline

Omers considers sale of ERM for £2.5bn – report

Omers Private Equity acquired ERM from Charterhouse for an enterprise value of $1.7bn in June 2015

Omers leads £6m series-A for Vara

Omers Ventures associate director Bryony Marshall will join the board of the company

Omers Ventures Fund IV closes on $750m

Fund targets growth-orientated, disruptive technology companies based across North America and Europe

Omers leads €16.25m series-B for Deliverect

Omers Ventures managing partner Jambu Palaniappan will join the Deliverect board

Omers-backed ERM acquires MJ Bradley & Associates

GP in 2015 paid an enterprise value of $1.7bn to acquire ERM from Charterhouse Capital Partners

Omers Ventures et al. back $110m round for WeFox

Round brings the series-B total to $235m and values the digital insurance provider at more than $1bn

Omers Ventures leads $5.2m round for Quorso

Business software company intends to use the investment from the series-A round to expand abroad

Omers Ventures leads €18.5m series-B for FirstVet

Fresh capital will enable FirstVet to expand its service globally and launch in other markets

Omers Ventures launches in Europe

Omers Ventures currently manages CAD 800m, and has previously invested in Shopify and Hopper

Omers-backed Trescal makes two overseas bolt-ons

French calibration services specialist buys Texas-based MATSolutions and Asia-based NorthLab