Venture

Base10, Cathay in $12m series-A for Lana

French venture capital house Cathay Innovation and Spanish ride-sharing company Cabify take part in the round

Consortium in $100m round for Omio

Fresh capital will be used for organic growth activities and M&A opportunities

Global Brain extends series-A for Element Insurance

Global Brain is investing from its SFV GB Fund, a joint venture between Sony Financial Ventures and Global Brain Corporation

Bullnet Capital sells Codice SW to PE-backed Unity

Sale ends an 11-year holding period for Spanish venture capital firm Bullnet Capital

Horizon leads $5m round for Liki24

Fresh capital will be used to finance the company's further expansion in Europe

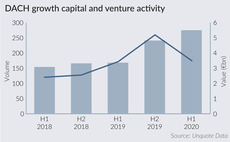

DACH venture and growth deals reach volume high in H1 2020

Growth and VC deal volume exceeded that of all previous half-yearly figures, although average deal size and fundraising activity declined

Notion leads €7m series-A for Claimsforce

Notion had been in discussions with the Claimsforce management team since Q1 2019

Augmentum et al. invest in £35m series-C for Habito

Entrepreneur Yuri Milner's investment vehicle Gemini led a ТЃ25m equity raise for the company in February

Moira invests in Voovio Technologies

Company plans to use the fresh capital to expand its US operations and further develop its cloud services

Venture, tech keep UK market afloat in H1

Buyout and exit volume dropped dramatically in the first half of 2020, while GPs are doubling down on technology-driven strategies

Venture capital fund invests in Antikytera E-Technologies

Company plans to use the fresh capital to further expand, develop new features and scale up its team

VCs in €5m round for Klima

EVentures, 468 Capital and HV Holtzbrinck back the round for the climate change mitigation app

Shark Solutions raises funding from Circularity Capital

Company will use the proceeds to develop its manufacturing infrastructure and to expand its product range

La Famiglia announces second fund

B2B-focused venture capital fund has made eight investments so far and is targeting €50m

VCs sell stakes in Kandy Therapeutics to Bayer

Backers included Advent Life Sciences, Fountain Healthcare Partners, Forbion, OrbiMed and Longitude

GED invests in SimpleCloud via Conexo Ventures

SimpleCloud plans to use the fresh capital to accelerate its international expansion, primarily in the US

P101 in €6.4m round for WeSchool

CDP Venture and Tim Ventures take part in the round, alongside Club Digital and Club Italia Investimenti 2

Nuo Capital, Olma in €4.5m round for Artemest

Early-stage investor Italian Angels for Growth and Swiss holding company Brahma also take part in the round

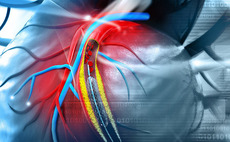

Panakes et al. in €20m series-B for InnovHeart

Indaco Venture and CDP Venture Capital also take part in the round, alongside previous backer Genextra

Axon launches €150m fourth innovation growth fund

Fondo Axon Innovation Growth IV acquires minority stakes in technology businesses with high-growth potential

Versant Ventures invests $30m in Matterhorn Biosciences

Versant has launched the T-cell therapy developer in partnership with the University of Basel

Heal Capital, EBRD in $10.25m series-A for Infermedica

Round also saw participation from existing investors Karma Ventures, Inovo Venture Partners and Dreamit Ventures

Verizon Ventures, PME Investimentos in €4m round for PicAdvanced

PME invests via Fundo 200M, a €200m co-investment vehicle that supports the expansion of Portuguese startups

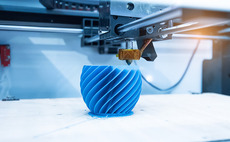

Nordic Alpha Partners et al. in $14m round for DyeMansion

Series-B round follows a seed round in 2018, backed by BtoV, AM Ventures and Unternehmertum