Analysis

VC Profile: Vektor Partners backs tech mobility transformation with new fund

VCтs debut fund has a EUR 175m hard-cap and aims to back startups with initial tickets of EUR 3m-EUR 5m

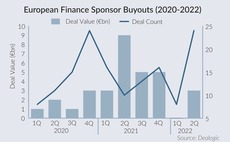

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

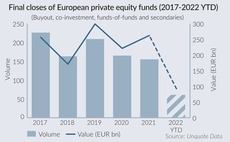

PE fundraising pipeline offers hope amidst slowdown in H1 2022

Final closes down by almost half so far this year, but a number of "mega-cap" vehicles in coming months could still bolster 2022 fundraising

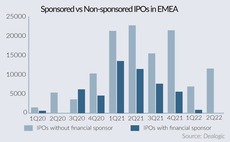

Corporates best placed for autumn IPO window as sponsors sit out

GPs expected to continue to ditch listings in the short term in favour of sale exits, longer holding periods

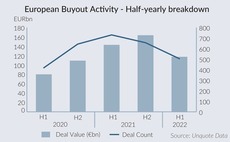

Deft deployment, creative exits drive PE agenda into H2 2022

Take-privates, bolt-on opportunities and demand for resilient healthcare and technology assets offer hope for challenging second half of the year

Women lead push for diversity in PE, M&A

Supporting diverse hires and leadership, as well as opening up networks, remain key

VC Profile: Octopus backs pre-seed ecocystem with fresh fund

Fund is headed by Kirsten Connell and Maria Rotilu and has extended its hard cap to GBP 15m following a first close

GP Profile: Ergon hones in on long-term trends, ESG agenda

The European mid-market sponsor is eyeing growing and resilient businesses with its EUR 800m Fund V

GP Profile: Kyip Capital on debut fundraising, opportunities in Italian education

After interim close, Milan-based fund seeks up to EUR 165m by early 2023; eyes deals to grow data validation business and university platform

Pemberton assesses European market for NAV strategy

Having hired Tom Doyle from 17Capital, the firm is looking at trends including generational change and market consolidation that will drive demand for strategy

GP Profile: Jet Investment doubles down on industrial impact ahead of next fundraise

Central European industrials-focused GP is in the planning phase for Jet 3 Fund and is eyeing further deals and exits

French sponsor-led deal flow pushes through despite war in Ukraine stalling some auctions

YTD sponsor-led transactions value have so far seen the second highest performing year since 2015

Podcast: In conversation with... Mark Corbidge, Sun European Partners

Sun European Partners' Mark Corbidge tells Unquote about the GP's strategy and current market view

VC Profile: Jeito Capital in final stretch of biotech fund deployment

Founder Rafaèle Tordjman outlines the French sponsor’s strategy as it aims to remain independent amid wave of consolidation in healthcare funds

GP Profile: Nordic Alpha Partners on hard-tech, hypergrowth mode

Co-founder Laurits Bach SУИrensen tells Unquote about the Danish growth investorтs value creation model and plans for future investments

European PE fundraising forges ahead amidst macro uncertainty

Unquote explores LP preferences, GP behaviour and the challenges ahead in what many expect to be a record fundraising year

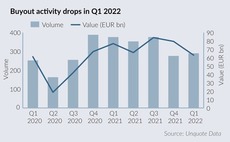

European Q1 deal value drops amid market volatility

Buyouts in the first quarter fell to EUR 62bn, the lowest level since the recovery from the pandemic started

GP Profile: Patrimonium Private Equity aims for full fund deployment and add-ons in 2022

Swiss sponsor has EUR 150m in fund commitments and expects two to three more platform deals this year

CVC's Amsterdam IPO move adds impetus to calls for LSE reform

CVC Capital Partnersт reported preference for Amsterdam as a potential home for its shares shows that Londonтs regulatory regime still needs to be far more flexible, several sources said.

GP Profile: 17Capital eyes buoyant NAV financing market

Unquote speaks to managing partner Pierre-Antoine de Selancy about the GP's strategy and market view

Nordic M&A to withstand mounting macro and geopolitical pressures - panel

Restructurings, take-privates and US interest on the rise, while Q1 2022 buyouts are likely to drag behind

Pollen Street to expand investment strategies in public market foray

UK alternative asset manager will seek to carve out a niche for itself with existing and new strategies after merger with Honeycomb

CapMan seeks event-driven opportunities with Special Situations fund

Expected to close in the autumn, the vehicle has Tesi as anchor investor and could attract some European LPs

GP Profile: BC Partners looks to steady deployment ahead of next fundraise

Head of IR Alexis Maskell details the GP's plans to lay strong foundations for when it next hits the road, possibly in H2 2023