Research

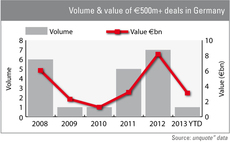

Germany: large-cap deals on the rise

CVC’s €3.1bn buy-back of German metering business Ista this month has sparked speculation about a revival of Germany’s large-cap market.

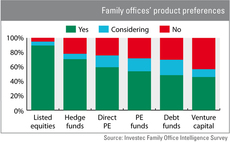

Family offices keen on bypassing GPs?

Nearly 60% of family offices polled in the Investec Family Office Intelligence Survey are considering investing in private equity. The headline figure is not the whole story, though.

Gap narrows between trade sales and SBOs

Trade sales and SBOs have posted remarkably similar figures in the past six months indicating a narrowing of the historic gap between the two types of exit.

Lower mid-cap renaissance for London in 2012

London was home to a noticeable dealflow uptick in the ТЃ5-50m segment last year, with both activity volume and overall value up by more than 30% on 2011 figures.

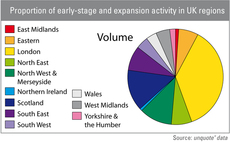

London & Scotland see most growth investment

In 2012, the UKтs venture and growth capital scene was once again most active in London, where unquoteт data recorded 82 transactions with a combined value of ТЃ734m.

unquote" Regional Mid-market Barometer

A rise in alternative lenders and a strong trade buyer presence helped drive the UKтs mid-market in 2012, according to the latest unquoteт Regional Mid-market Barometer, published in association with LDC.

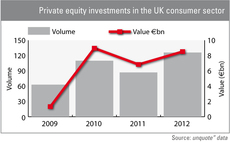

UK consumer sector: private equity dealflow up 45% in 2012

High street woes notwithstanding, the UK consumer sector proved to be ripe for investment opportunities last year: private equity dealflow was up by 45% compared to 2011 figures while the overall value of these investments rose by a quarter.

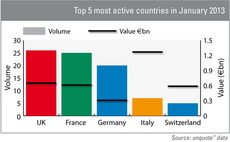

Italy shines in January thanks to CVC mega-buyout

Italy topped Europe's private equity value charts in January, while the UK recorded the most deals, showing both familiar names and outliers starting 2013 on a high.

Capital cities attract most private equity investments

Europe’s capital cities attract the lion's share of private equity investment, though other regions in Europe have been shown to be very active, according to new research from unquote” data.

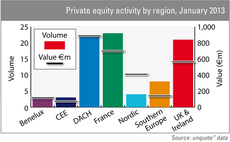

UK activity falls behind France and DACH

The UK & Ireland private equity market has been overtaken by the French and DACH regions in January according to figures from unquoteт data.

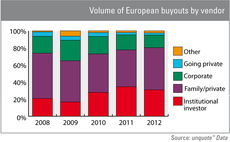

SBOs subside in 2012

Following a record 2011, the volume of “pass-the-parcel” deals abated slightly last year – but primary transactions still have a long way to go before returning to their pre-crisis glory.

Early-stage deals bounce back in Q4

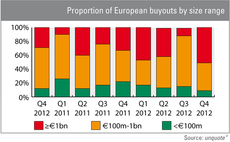

After a slow summer, early-stage investments took off in Q4, according to the latest unquote” Private Equity Barometer, published in association with Arle Capital Partners.

Growth equity deals enjoy Q4 uptick

Growth capital investment activity recovered substantially in Q4 following a poor third quarter, but remains low compared to recent historical averages.

Mega-buyouts bolster Q4 activity figures

The €11.6bn overall enterprise value of Q4’s large-cap deals is the largest total since the third quarter of 2010, which itself was by some margin ahead of every quarter since Q3 2007 (see chart).

unquote" Private Equity Barometer - Q3 2012

Private equity dealflow has remained subdued over the three months to September, with the number of transactions completed plummeting 35% to 182 deals while the aggregated value dipped 14% to €11.7bn.

Retail sector activity benefits from economic woes

The current economy has forced most retail businesses to rethink their strategy, leaving enough space for private equity firms to come in and get their share.

Germany quiets down in Q4

After a substantial increase in deal activity in Q3, the German private equity market grew quieter again towards the end of 2012.

PE-backed IPOs few and far between in 2012

Moleskine might make headlines if and when it finally lists on the stock market later this year, but flotations remained a seldom-explored exit route for GPs in 2012, continuing a trend initiated in 2008.

Cinemas could be the big deal in 2013

While Terra Firma is considering getting out of the movie business, its private equity competitors could see some very attractive investment opportunities this year.

European buyout dealflow falls 30% year-on-year

Despite a strong showing by the UK market, European buyout activity fell by almost a third volume-wise in 2012, according to unquote” data.

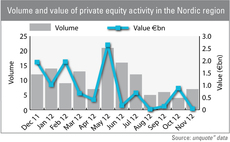

Frozen Nordic market

In just two years, Sweden has lost half of its deal volume, showing that even the popular Nordics are not immune from Europe's economic drag.

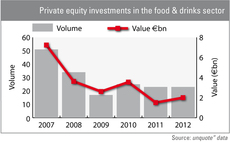

PE houses still hungry for food & drinks assets

Although most of the large food & drinks deals have seen private equity firms on the sell-side this year – including the recent sale of KP Snacks by PAI partners and Blackstone Group – unquote" has also noted a timid recovery for investments in this sector...

Italy is different

While the doom and gloom settles in the rest of Europe, Italian private equity professionals advertise a cautious optimism despite decreasing activity in the country.

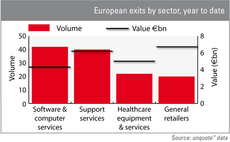

Software and retail lead 2012 exit league

General retailers and software & computer services lead the exit rankings for 2012.