Research

French deal volume at 14-year low

French investment volumes in 2012 are set to be the lowest seen in the country for over a decade, according to the latest figures from unquote” data.

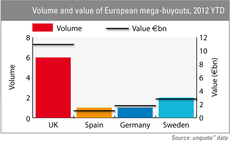

UK mega-buyouts worth more than €10bn this year

In defiance of problems on the continent, the UK has seen a surge in mega-buyouts this year, topped off with the recent acquisition of Annington Homes for ТЃ3.2bn.

Volume of exits increases in October

After a slow September, exits picked up again last month, but overall volume seems lower as the year comes to an end.

The pitfalls of turnaround investing

Turnarounds are in the news once again, with the decision by specialist investor OpCapita to put struggling electricals retailer Comet into administration. Last week, Deloitte took over the administration of the business, and on Monday made over 300 staff...

Sweden continues to lead Nordics

Sweden outpaced its Scandinavian neighbours in the 12 months leading up to November. A SVCA study shows that industry optimism returned just in time for year-end.

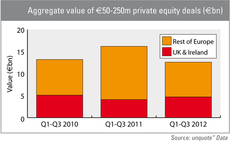

UK lower mid-market resilient in 2012

While activity in the тЌ50-250m segment has failed to improve on 2011 figures on a pan-European level, the UK is proving to be fertile ground for deal-making in an otherwise troubled macroeconomic environment.

Turkey rises to the challenge

Turkey is slowly but surely establishing itself as a prominent market for private equity in Central and Eastern Europe along with Russia and Poland.

SBOs back with a vengeance in Q3

Secondary buyouts (SBOs) climbed back to prominence in the third quarter of 2012. The number of such deals rose from 28 to 34 compared to Q2, making it the only buyout segment to record an increase in an otherwise faltering market.

Industrials and consumer see most volume in 2012 to date

The industrial and consumer sectors outperformed other major industries in terms of deal volume between January and September 2012.

Unquote" Regional Mid-Market Barometer

The latest unquote" Regional Mid-Market Barometer, produced in association with LDC, shows that mid-cap investors are not letting a lacklustre economy hamper their ability to close deals.

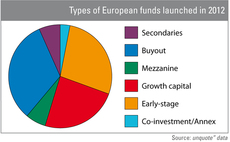

Secondaries and mezzanine vehicles proving popular in 2012

Looking at the funds launched so far this year in Europe shows sustained appetite for mezzanine and secondaries vehicles, reflecting current investment opportunities and subsequent LP interest for the private debt and secondaries markets.

Germany Report 2012

In the unquote" Germany Report 2012, we take a look at how macro-economic issues are hampering German investment activity, despite its robust domestic market.

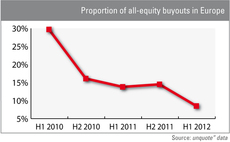

Spread between leverage and all-equity deals widens on investor scepticism

All-equity deals are decreasing as a percentage of overall buyouts, indicating investors are adopting a "wait-and-see" approach to financing.

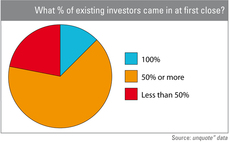

Fundraising research reveals optimism in tough times

Despite talk of apocalyptic investor behaviour, most GPs announcing a close this year reported existing LPs re-upping Т and even increasing ticket sizes, as revealed in an unquote" survey of more than 40 European GPs. Anneken Tappe reports

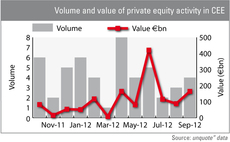

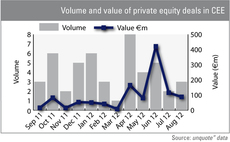

CEE picking up the pace

Dealflow in the CEE region picked up slightly in August, and the handful of deals closed so far in September hints at a busy Autumn ahead.

Mediq deal to boost 2012 P2P figures

The planned €775m takeover of Dutch pharma company Mediq by Advent could help boost public-to-private (P2P) activity figures, which have been on the wane since 2010.

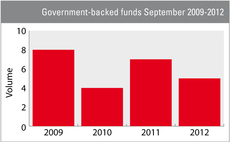

2012 sees fewer state-backed funds

Fewer government-backed funds have been launched in 2012 than in previous crisis years, suggesting that either the market is picking up, or that even governments' aid efforts are failing.

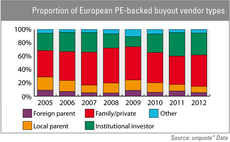

Corporate spin-offs still few and far between

Primary transactions tend to be harder to source across the board nowadays, but corporate spin-offs have proved particularly elusive since 2009: while deals sourced from a trade player accounted for nearly a fifth of European buyout dealflow that year,...

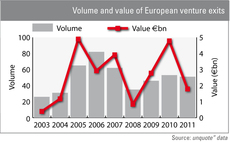

Successful exits bring venture back into the game

Venture is bouncing back since its 2008 trough, and now sees over 50 exits per year in Europe. These exits are not just about quantity, but also quality, with some of Europe's best-loved VCs sharing the limelight with lesser known players.

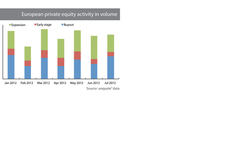

European buyout dealflow picks up in July

European private equity dealflow remained stable in July, with an increase in buyout activity making up for lackluster growth capital and early-stage investments, resulting in a significant value uptick.

Healthcare investments wane after strong Q2

Investment in the healthcare industry is facing tough times as total deal value falls to its lowest level in 18 months.

Financials regain traction in summer

After a strong start in January, investments in financials slumped in both volume and value, following a bumpy path before gaining some more traction again in July.

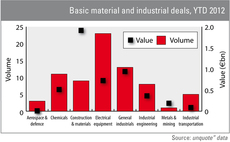

Ahlsell deal boosts construction sector value total

The construction & materials sector has seen €1.9bn worth of private equity deals being completed since January, exceeding the overall amounts invested in other industrial sub-sectors.

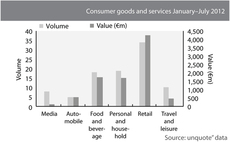

European retail outshines rest of consumer sector in 2012

Retail has seen private equity transactions totalling €4.3bn since January 2012, outpacing the rest of the consumer goods and services sector.