Research

Strong second half boosts UK year-end activity figures

Read the latest unquoteт Regional Mid-market Barometer, published in association with LDC

Q4 Barometer: dealflow bounces back

Following a weak Q3, the final months of 2013 marked the strongest quarter of the year, according to the latest unquoteт Private Equity Barometer, published in association with SL Capital Partners.

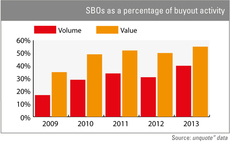

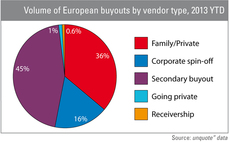

SBOs hit new peak in 2013

Secondary buyouts rose to new levels of prominence in the European market last year, accounting for 40% of all buyouts and 55% of aggregate buyout value. Greg Gille reports

UK Watch: 2013 goes out with a bang

A strong final quarter for 2013 saw deal volume and overall value hold up well across the board in the UK, showing a marked improvement on the first quarter of the year, according to the latest unquoteт UK Watch, published in association with Corbett...

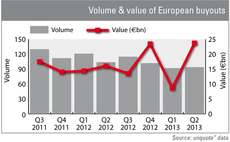

2013 buyouts: overall value stabilises around €75bn

The overall value of European private equity-backed buyouts has hovered around the тЌ75bn mark for the third year in a row, with last year's deals totalling тЌ74.7bn.

Have your say: UK Watch

With 2013 now behind us and market participants gearing up for a busy 2014, where do you see the UK market heading in the coming months?

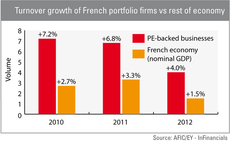

French PE-backed firms outperformed rest of economy in 2012

French private equity-backed companies significantly outperformed their peers in terms of job creation and turnover growth in 2012, according to a new survey by Afic and EY.

European private equity activity drops to 2005 lows

Findings from the latest unquote” Private Equity Barometer, published in association with SL Capital Partners, reveal a worrying drop in deal volumes, falling to the same level as Q4 2005.

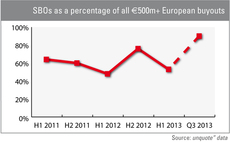

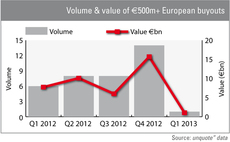

SBOs account for 90% of €500m+ dealflow in Q3

The latest quarterly figures from unquote" data show that while the wave of secondary buyouts seems to have hit its apex in overall volume terms, such deals are still disproportionally prominent in the large-cap space.

Fundraising: Germany's drawing power

The number of funds raised by German players – and the amount of capital they have been able to draw in – has increased steadily in the post-crash years.

Private equity still greedy for restaurants & bars sector

The buyout of Côte Restaurant by CBPE adds to an already busy year for investments in the eating and drinking sector, with activity recorded so far in 2013 already exceeding that of the whole of last year.

Large VC rounds: France outpaces neighbours

France was home to six of the 20 largest venture investments completed so far this year in Europe, with Germany following closely behind.

Early-stage deals further recover in Q2

Both the volume and overall value of early-stage activity registered a welcome uptick across Europe in the second quarter, according to unquote" data.

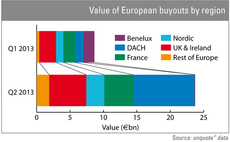

Germany shifts into overdrive in Q2

A string of mega-buyouts helped Germany secure the top spot on European buyout value tables in the second quarter of this year.

Q2: overall buyout value soars by 174%

The European buyout market recovered spectacularly in value terms in Q2 on the back of a string of mega-deals, but the overall volume of activity remains lacklustre.

"Pass-the-parcel" deals creep up in H1

Secondary buyouts have accounted for 45% of the overall number of buyouts in the first half of 2013, the highest proportion witnessed since the onset of the financial crisis, according to unquote" data.

Have your say: 60-second survey

60-second survey

Family Office Survey 2013

Keep up to date with the latest trends in the Family Office Investment In Private Equity survey, published in association with Investec.

Nordic Report 2013

Once the darling of European private equity, has the Nordic region lost some of its lustre?

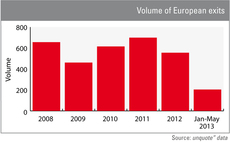

2013 exit activity on course to match quiet 2012

Divestment activity figures so far this year highlight the exit environment remains tough for GPs looking to return cash to investors – although recent weeks have seen positive trends unfolding.

Growth capital dealflow ebbs in Q1

Emphasising the pervasive nature of the activity decline in the first quarter of 2013, deal volume in the expansion category recorded a drop commensurate with that of the buyout market.

Q1 Barometer: Deal value hits four-year low

Q1 Barometer

Large-cap market awakens after tepid Q1

European buyouts valued in excess of €500m have been conspicuous in their absence in the first quarter following a flurry at the tail-end of 2012 – but recent weeks have shown signs of a revival.

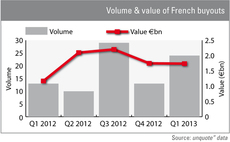

French buyouts up 50% YoY in Q1

The French buyout market enjoyed a much welcome uptick at the start of 2013, with both volume and overall value significantly up on Q1 2012 figures.