Sponsored

3i's Carnimolla and Howard on investing in naturality businesses

With a significant increase in the number of people focusing on their physical and mental wellbeing, 3i sees growing opportunities for PE

Unquote Private Equity Podcast: Partnering for portfolio management

Oliver Jones and David Wardrop discuss the potential for new investment opportunities in a post Covid-19 environment

Video: PAI's Harrington on harnessing technology to boost operations

PAI principal Max Harrington details how the firm has moved away from a complicated ecosystem of applications, people and spreadsheets

Video: DealCloud's Matthew Hardcastle on PE's tech revolution

In the first instalment of Unquote's Out-of-Office series, Hardcastle discusses how technology could help attract and retain more diverse talent

Buy-and-build: 3i's five-step strategy

Pete Wilson, partner and head of UK private equity at 3i, outlines some key considerations for executing successful bolt-on acquisitions

Impact investing webinar: Capital Meets Conscience

Watch a virtual event on impact investing, with panellists including Bridges' Maggie Loo and Daniela Barone-Soares from Snowball

Rutland Partners on empowering management

Rutland explains how management teams are at the core of its value-creation strategy

Q&A: Liberty Global's Simon Radcliffe on W&I claims

Radcliffe talks to Unquote about the W&I market, the drivers behind the increase in claims being made, and more

Style and substance: The growth of private equity in Italy

Latest edition of Gatti Pavesi Bianchi's new series on the M&A and private equity markets explores why the Italian PE scene is hitting new heights

Rutland Partners: Catalyst for Change

An in-depth look at how Rutland works in partnership with management to turn complexity into opportunity

Comment: Is your data strategy offensive enough?

3i digital director Simon Andersen shares his insight on how companies and their PE backers can best leverage the growing amounts of available data

Contrasting fortunes: debt and venture secondaries

Private debt secondaries have the wind firmly in their sails, while the longer-established venture secondaries space is still an acquired taste

Q&A: Rutland's Craddock on Aston Barclay and making partner

Special situations investor's newly appointed partner discusses the firm's evolution and its recent investment in the UK-based car auction business

Rise of the UK's private markets

Average values of British PE buyouts have soared over the last 20 years, as increasingly fewer businesses are trading on the London stock exchange

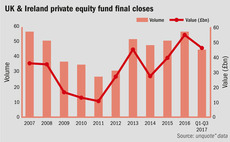

UK fundraising continues apace in 2017

Final closes in the first three quarters of the year show the UK is on track to surpass the post-crisis fundraising peak set in 2016

Q&A with Aztec Group's Harrison: Outsourcing demystified

Aztec's Harrison speaks with unquoteт about modern fund administration and how the role has adapted to a new market

Q&A: Rutland's Morrill and Wardrop on Millbrook and Pizza Hut

Special situations investor's partner and managing partner discuss the strategies behind the two award-winning investments

Q&A: Rutland Partners' Andy Powell

Powell discusses his new role at the firm and the opportunities ahead for special situations investors

UK healthcare market still fighting fit post-Brexit

Momentous changes in the UK's healthcare provision space and the potential for growth in related subsectors present opportunities for private equity

GP spinouts a game of planning, PR and partnerships

Investec Fund Finance: Strategic freedom and the promise of greater riches are two in a number of compelling arguments for PE spinouts

Could Brexit mean lighter regulation for private equity?

Taylor Wessing: UK will eventually decide to join the queue of other passport applicants, alongside the US, the Cayman Islands, Bermuda

Comment: Measuring the immeasurable

Environmental, social and governance considerations in developing markets can help identify the strongest assets and boost fundraising

Brexit: The only certainty is uncertainty

While the long-term economic pros and cons of severing EU ties are up for debate, short-term uncertainty would be troubling for business leaders

Navigating the complex world of co-investment

unquote" gleans insight from Capital Dynamics' David Smith on the intricacies of co-investment