Articles by Greg Gille

Entry multiples still in double digits for most popular European markets

The latest unquote” and Clearwater International Multiples Heatmap Report, now available for download, neatly reflects the ever-challenging environment for private equity investors.

Marlborough Partners and STJ Advisors join forces

Firms set up a joint venture to pitch integrated equity and debt services to clients worldwide

NorthEdge scores first exit with Accrol IPO

Tissue manufacturer has listed on AIM with a £93m market cap, less than two years after the investment

LDC adds to exit list with Workplace Systems trade sale

LDC sells Workplace Systems to US-based Insight Venture Partners portfolio company WorkForce

LDC sells NWTC pub chain to Graphite for £50m

Vendor reaps a healthy multiple by divesting the pub and restaurant business after three years

FPE backs internet provider Optimity

UK-based fund manager secures a significant stake in the telecoms provider

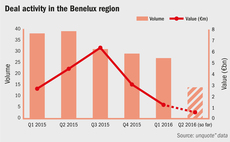

Usual suspects working hard in sedate Benelux market

Trend of declining dealflow in the region shows little signs of change, though buyout multiples return towards lower long-term averages

Northedge adds ex-PwC dealmaker as investment manager

NorthEdge Capital has hired Dan Matkin as investment manager to help deploy its new fund

Isatis reinvests in SPPP group alongside BPI France

Both investors had backed the plastics coating business in an MBO in 2012

Q1 Barometer: Slow start across Europe despite French uptick

The European buyout segment witnessed a slow Q1 volume-wise, with the number of deals recorded being the lowest total since Q1 2014

Navigating the complex world of co-investment

unquote" gleans insight from Capital Dynamics' David Smith on the intricacies of co-investment

Livingbridge injects £8m into The Up Group

Digital executive search and networking business targets further domestic and international growth

How French private equity creates value

French GPs rely overwhelmingly on organic EBITDA growth to drive value creation, according to a new, in-depth study conducted by trade body Afic and EY

Corporate finance firms Capitalmind, EquityGate to merge

Business will operate under the Capitalmind brand out of six European offices

Cathay's SeaOwl acquires Wellstaff

Cathay secured a minority stake in oil & gas services company SeaOwl in 2015

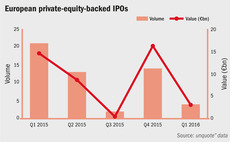

PE-backed IPO activity failed to ignite in Q1

Europe should see an uptick in IPOs throughout Q2 following one of the quietest first quarters on record, in terms of PE-backed flotations

XAnge, Entrepreneur Venture back €4m HomeRez round

Funding round also features several business angels and will mainly support technological development

KKR doubles money on SMCP sale to Chinese trade buyer

GP is understood to have scored an IRR in excess of 30% in slightly less than three years

Idinvest, Alven in €12m round for Frichti

French food delivery startup scores a double-digit round less than a year after inception

Eurazeo injects €134m into Les Petits Chaperons Rouges

French listed investor contributes in both equity and convertible bonds, BPI France co-invests for a minority stake

Activa Capital adds four to partnership

French mid-cap GP promotes Pierre Chabaud, Alexandre Masson, Benjamin Moreau and Jean-François Briand

Eurazeo PME acquires MK Direct from Alpha PE

The bedding company, which operates the Francoise Saget and Linvosges brands, is valued at €102m

Siparex, Sodero invest in DMVP

Siparex deploys capital from Xpansion 2, Nord Ouest Entrepreneurs 4 and Entrepreneurs 1 funds

NVM appoints new investment director

Charles Winward joins the investment team to source, transact and manage VCT investments