Articles by Greg Gille

Diana sale could yield €1bn for Axa PE

Axa Private Equity is mulling a sale for French food ingredients business Diana Ingredients, according to reports.

Blackstone, Carlyle targeted by Stop G8 protests

Anti-capitalism protest group Stop G8 has publicised the London addresses of several private equity firms – including Blackstone, Carlyle and Lion Capital – ahead of the G8 Summit in June.

AFM-Téléthon and FNA launch biotherapy-focused fund

Charity AFM-Téléthon and French state-backed fund-of-funds Fonds National d'Amorçage (FNA) have committed €50m to a new seed fund dedicated to biotherapy and rare diseases research.

Ace invests €8m in Asquini-Sofop Aero

Ace Management has made an €8m investment to back the merger of French aerospace parts manufacturers Asquini and Sofop.

DN Capital leads series-A round for Scarosso

DN Capital, IBB, Perikles Ventures and local angel investors have provided German footwear business Scarosso with a series-A round of funding.

Ventech leads €3.1m round for Sticky Ads TV

Ventech and previous backer Isai have provided French online advertising agency Sticky Ads TV with €3.1m of growth capital.

Natixis buys Euro Private Equity

Natixis has added another firm to its private equity arm by acquiring Swiss funds-of-funds manager and investment adviser Euro Private Equity.

Sun-backed Atmosphere goes into administration

Atmosphere Bars and Clubs, a UK-based portfolio company of Sun European Partners, has gone into administration.

Rothschild holds €235m first close for private debt fund

Rothschild's Five Arrows Credit Solutions (Facs), a debt fund focused on the western European mid-market, has held a first close on €235m.

Holding periods stretching amid tough exit environment

Holding periods

Benelux unquote" May 2013

Benelux punched above its weight in April with two private equity-backed IPOs, following on from other listings in recent weeks.

Bayside and LBO France inject fresh money into Consolis

Bayside Capital and owner LBO France have respectively injected €45m of new debt and an equal amount of fresh equity into the refinancing of Belgian concrete manufacturer Consolis.

Law firm Edwards Wildman Palmer opens in Istanbul

Private equity-focused law firm Edwards Wildman Palmer (EWP) is set to open an office in Istanbul, covering the CEE and MENA regions in addition to the Turkish market.

CIC Mezzanine closes third fund on €165m

CIC Mezzanine has closed its third vehicle, CIC Mezzanine 3, on €165m – comfortably exceeding its €120m target.

Arkea Capital and SGCP buy 20% of Piriou

Arkea Capital Investissement and Société Générale Capital Partenaires (SGCP) have each acquired a 10% stake in French ship builder Piriou from Jaccar Holdings.

Idinvest ups private debt fund in €205m interim close

Idinvest Partners has held an interim close on €205m for its senior debt vehicle Idinvest Dette Senior.

PE and trade players neck-and-neck on mid-market pricing

Mid-cap valuations

Growth capital dealflow ebbs in Q1

Emphasising the pervasive nature of the activity decline in the first quarter of 2013, deal volume in the expansion category recorded a drop commensurate with that of the buyout market.

Equita acquires MEN Mikro Elektronik

German private equity house Equita has acquired MEN Mikro Elektronik, an embedded electronics manufacturer, in a deal that values the company at €25-50m.

Cinven's Partnership Assurance to float on LSE

Partnership Assurance Group (PAG), a financial advisory company owned by Cinven, has announced plans to float in London in June, in an IPO that could reportedly value the business at up to £1bn.

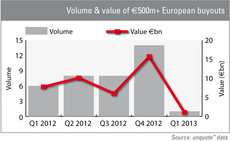

Large-cap market awakens after tepid Q1

European buyouts valued in excess of €500m have been conspicuous in their absence in the first quarter following a flurry at the tail-end of 2012 – but recent weeks have shown signs of a revival.

Calao invests in Contrejour

French GP Calao Finance has provided shutters manufacturer Contrejour with fresh equity.

Balderton on the road for fifth fund

Venture firm Balderton Capital has started marketing its new vehicle, according to documents filed with the US's Securities and Exchange Commission (SEC).

Adams Street closes Secondary Fund 5 on $1bn

Adams Street Partners has closed its Global Secondary Fund 5 on its $1bn hard-cap.