Articles by Greg Gille

XAnge divests RunMyProcess stake in trade sale

XAnge Private Equity has sold its stake in French cloud computing solutions developer RunMyProcess (RMP) to Japanese trade player Fujitsu.

VC-backed SpineGuard to list on Alternext

SpineGuard, a French medical equipment producer backed by several venture capital firms including Omnes Capital, is set to list on NYSE Alternext by the end of April.

Ace Management in €4m round for Ocea

Ace Management has joined existing investor Edmond de Rothcshild Investment Partners (EdRip) in a €4m round for French aluminium boats manufacturer Ocea.

Demeter et al. inject €7m into Ideol

Demeter Partners, Sofimac and Soridec have provided Ideol, a French developer of foundations for offshore wind farms, with €7m of funding.

France: commitments from banks, insurers, pension funds down 43%

France's lacklustre fundraising figures for 2012 highlight the continued retreat of traditional LPs, such as banks, insurers and pension funds, according to new research by industry trade body Afic.

Clifford Chance poaches Ashurst's Xavier Comaills

Ashurst partner Xavier Comaills is set to join Clifford Chance and head the firm's fund structuring practice in Paris.

Newfund invests in XOR Motors

Venture capital Newfund has backed XOR Motors, a French manufacturer of electric scooters.

Electra finalises UBM data services acquisition

Electra Partners has acquired the majority of UBM's data services businesses, a deal agreed to in February.

CM-CIC and IDI exit Alti in €75m trade sale

CM-CIC LBO Partners and IDI have sold French IT engineering firm Alti to a subsidiary of Indian conglomerate Tata in a €75m all-cash transaction.

Labco: formal bids expected next month

3i-backed medical diagnostics company Labco formally launched its sale process at the end of January and first bids are expected in May.

Altius appoints senior associates

Funds-of-funds manager Altius Associates has appointed Jeffrey Kopocis and Arnaud Garel-Galais (pictured) as senior associates in its global investment team.

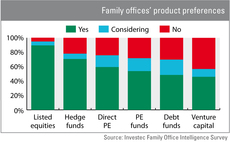

Family offices keen on bypassing GPs?

Nearly 60% of family offices polled in the Investec Family Office Intelligence Survey are considering investing in private equity. The headline figure is not the whole story, though.

Silverfleet buys Ipes from RJD for £50m

Silverfleet has acquired fund administration business Ipes from RJD Partners for £50m.

Qualium to re-inject €30m into Quick as part of amend-and-extend

French investor Qualium is set to invest a further €30m of equity in restaurants chain Quick while the company's lenders have agreed to extend the terms of its debt, which was due to mature in 2015.

Record dry powder to expire in 2013, says Triago

Despite an expected increase in capital calls this year as GPs put more money to work, nearly $15bn worth of LBO commitments could be left unused and returned to investors in 2013, according to placement agent Triago.

France Telecom moves forward on EE sale

France Telecom has reportedly hired banks to advise on the dual-track sale process of mobile operator Everything Everywhere (EE), which attracted private equity interest last summer.

FSI et al. in €28m round for SuperSonic Imagine

A consortium of investors, led by the Fonds Stratégique d'Investissement (FSI) and comprising several European venture players, has provided ultrasound systems developer SuperSonic Imagine with a €28m round of funding.

Cisco buys venture-backed Ubiquisys for $310m

Small cells developer Ubiquisys, a portfolio company of Advent Venture Partners, Accel Partners and Atlas Venture, has been bought by US corporate Cisco for $310m.

Astorg seals Areva unit purchase

French GP Astorg Partners and energy company Areva have signed an agreement for the takeover of Canberra, Areva’s US-based nuclear measurement subsidiary.

Iris and Isai inject €2m into InstantLuxe

French venture capital firms Iris Capital and Isai have provided online marketplace InstantLuxe.com with a €2m round of funding.

Newfund backs Brazeco with €500,000

Newfund has invested €500,000 in Brazeco, a French producer of compressed wood logs.

Lise Nobre joins Parvilla as fundraising continues

Mid-market fund-of-funds Parvilla has hired former PAI partners deal-doer Lise Nobre as a partner.

Cécile Mayer-Lévi leaves Axa Private Equity

Cécile Mayer-Lévi, the co-head of Axa Private Equity's private debt operations, has left the firm.

Montefiore takes majority stake in BVA

French GP Montefiore Investment has bought a majority stake in opinion polls and social research business BVA.