Articles by Denise Ko Genovese

GP Profile: Nordic Capital

Since 1989, Nordic Capital has invested €11bn's worth of equity in 250 corporate acquisitions

Pamplona raises €3bn for Fund V

Fund close comes on the back of last year's $1bn raise for the GP's first TMT fund

Hayfin raises €2.2bn for special opportunities

Credit specialist will take part in rescue financings and debt restructurings

GP Profile: Bridgepoint

Plans to launch Bridgepoint Growth take shape as GP returns €1.6bn to investors

Permira raises €1.7bn for third debt fund at final close

Including leverage, total deployable capital amounts to €2.1bn

DH Private Equity Partners registers new fund

One of the oldest sponsors is back in the market after a two-year hiatus

Permira Debt Managers set to close third direct lending fund

With the end of its latest fundraise in sight, the credit specialist is in full deployment mode

European leveraged loans rocket in Q1 on back of favourable terms

Opportunistic recaps and refinancings, with borrowers taking advantage of lower pricing, led to a 140% uptick in loan volume in Q1

GP Profile: Palamon Capital Partners

Pan-European mid-market GP has experienced an evolution in the mid-market space and the institutionalisation of PE as a whole

GP Profile: Advent International

Recent investments for the firm include V Group, Integer.pl, Brammer, ATI Physical Therapy and Inventiv Health

GP Profile: Lion Capital

Mid-market investor remains dedicated to its focus on consumer deals despite growing competition, though it may focus on fewer investments

GP Profile: Lonsdale Capital Partners

GP held a final close for its maiden buyout fund on £110m in April 2016 after having previously invested on a deal-by-deal basis

GP Profile: Mobeus Equity Partners

GP is nearing the end of its first institutional fundraising efforts, with its 2016-vintage maiden vehicle targeting £150m

GP Profile: Bain Capital

GP is currently investing from its $3.5bn fourth European buyout vehicle, which closed in 2014

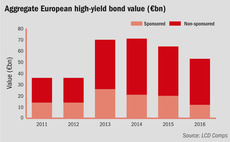

High-yield issuance for PE buyouts hits six-year low

Loan market flexibility and pricing steal the limelight as high-yield market for buyouts raises lowest total since 2010

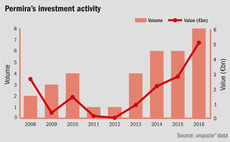

GP Profile: Permira

Global large-cap investor closed its latest buyout fund on €7.5bn in February 2016, making three investments from it to date

Alcentra, Hayfin close two multi-billion direct lending funds

Two credit specialists both close a second mid-market debt fund

In Profile: Ardian

Celebrating its 20-year anniversary in 2016, the GP has differentiated over time with funds covering multiple investment approaches

Debt advisory: Holding the cards in sell-side processes

Advisory firms often hold all the cards when pre-emptively introducing potential lenders to future sales processes

Debt advisory: Building bridges between sponsors & lenders

Debt advisory role is growing increasingly prevalent in the European mid-market private equity space

In Profile: Apax Partners

GP closed its ninth fund in 2016 on its hard-cap of $9bn and recently made high-profile exits including the 2015 IPO of Auto Trader

Quadrivio exits Pantex in trade sale

Exit is the seventh completed by Quadrivio from its Quadrivio Q2 vehicle

Siparex buys stake in HNH Hotels

French GP will support growth with an aim to double turnover and the number of rooms in the next five years

Oakley adds Charterhouse partner Mornington to string of hires

New partner will focus on deal origination, deal execution and portfolio management