Articles by Francesca Veronesi

Stirling Square buys Verescence in SBO

GP buys France-based Verescence, a glass packaging specialist, from Oaktree

Access holds €768m final close for ACF VII

Funds-of-funds vehicle backing European buyout funds exceeds its €500m target

IK's Mademoiselle Desserts bolts on Les Délices des 7 Vallées

France-based Mademoiselle Desserts completes its second bolt-on since the IK acquisition

Inflexion, NVM exit CloserStill Media in SBO

Inflexion acquired a minority stake in CloserStill through its Partnership Capital fund in 2015

Omnes, BPI France back UnitE

GPs invest in the France-based hydropower specialist via renewables-focused funds

French PE market overtakes UK

With a stark drop in H2, the UK's buyout volume looks certain to finish the year short of 2017's total

Victus Participations backs PB Techniek MBO

Amsterdam-based GP buys PB Techniek, a service provider to the horticulture industry

YFM reaps 3.4x on sale of GTK

Sale of the UK-based provider of electronics to a strategic trade buyer generates a 36% IRR

Carlyle's Prima Solutions bolts on Effisoft

Prima and Effisoft combined form an insurtech company generating €50m revenues

Naxicap's DCI bolts on Retis

DCI’s bolt-on of communications specialist Retis follows the acquisition of Lhexian last year

Omnes holds €72m interim close for Expansion III

GP plans to hold a final close in H1 2019, sets target at €120m and hard-cap at €150m

Kurma holds first close for Kurma Biofund III

LPs including Servier, BPI France and Idinvest commit to the biotech- and heath-focused fund

BC Partners and PSP sell Antelliq to trade in €3bn deal

Merck will pay around €2.1bn to buy the outstanding shares of and assume the €1.15bn debt

Siparex et al. back Mathevon in SBO

Transaction sees Aquasourca, Garibaldi Participations, Esfin Gestion and BPI France exit

Adaxtra et al. back Groupe Asia in MBO

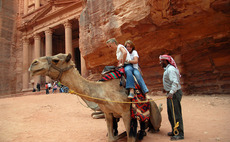

GPs invest in tour operator Groupe Asia alongside the CEO and the Chantraine family

Andera sells Scalian to Cobepa – reports

Andera wholly owns the engineering consultancy, having acquired stakes in 2015 and early 2018

Panakès et al. back €9m series-B for Carthera

Consortium of investors back Carthera to accelerate the development of its clinical pipeline

Main Capital-backed SDB Ayton bolts on Cormel IT

Under Main’s ownership since May, SDB Ayton buys Cormel IT to broaden its product portfolio

Rabo PE backs V&S Food Specialist

GP buys a 40% stake via Rabo Pariticipaties in Netherlands-based V&S Food Specialist

Vendis Capital buys Alpine

Vendis buys Netherlands-based Alpine Holding, an earplug manufacturer, from its founders

NPM Capital to sell Iddink to trade in €277m deal

Netherlands-based Iddink Group, an educational platform, is sold to Finnish Sanoma Group

Bridgepoint hires Huët

HuУЋt, former CFO of Unilever and Bristol-Myers Squibb, joins Bridgepoint's advisory board

Weinberg CP launches impact fund

WCP Impact Dév expects to hold a first close in 2019 and will inject €5-20m in businesses

Alpina-backed Germanedge buys Objective International

GP acquires a 70% stake in Objective, while the management team has retained the remainder