Expansion

CDC Entreprises et al. invest €7m in Compario

CDC Entreprises, Capitalaria, iSource Gestion and XAnge Private Equity have participated in a €7m funding round for French software-as-a-service (SaaS) firm Compario.

Isai invests €2m in Hospimedia

Isai Gestion has injected €2m into French medical information website Hospimedia, in what marks the first investment from its latest fund.

Enterprise Investors injects €2.2m into EP Serwis

Enterprise Investors has completed a €2.2m financing round for Polish pallet services company EP Serwis.

Index Ventures leads $24m round for Elasticsearch

Index Ventures, Benchmark Capital and new investor SV Angel have backed Dutch data analytics company Elasticsearch with a $24m series-B round of funding.

CDC Entreprises, I-Source, Bouygues in €3.7m round for Ijenko

French energy management solutions provider Ijenko has raised €3.7m in its third round of institutional funding since 2010.

Norvestor backs Robust

Norvestor has invested in the steel door division of Sweden- and UK-based Robust AB, which specialises in the production and sale of steel security and fire doors.

NBGI backs Cosalt Offshore

NBGI Private Equity has acquired the Aberdeen and Norway operations of oil services company Cosalt Offshore to merge them with its portfolio company ATR Group.

LDC backs barriers manufacturer ATG Access

LDC has made a minority investment in ATG Access, a British manufacturer of vehicle barrier systems.

Scottish Enterprise et al. back Lux Assure

Scottish Enterprise has taken part in a ТЃ3.25m funding round for Edinburgh-based technology development business Lux Assure.

Ace and CM-CIC in €3.2m round for Socomore

Ace Management and existing backer CM-CIC Capital Finance have taken part in a €3.2m funding round for Socomore, a French producer of surface treatment solutions used in the aerospace industry.

HTGF backs linkbird

High-Tech Gründerfonds (HTGF) and six business angels have backed Berlin-based technology company linkbird.

BGF backs Aubin with £2.3m

The Business Growth Fund (BGF) has backed Scottish oil and gas services company Aubin with a ТЃ2.25m investment.

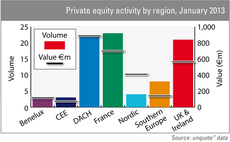

UK activity falls behind France and DACH

The UK & Ireland private equity market has been overtaken by the French and DACH regions in January according to figures from unquoteт data.

Greylock Partners backs Social Point

US venture capital investor Greylock Partners has reportedly injected $2.9m into Spanish online games producer Social Point.

3i-backed Trescal in Isocal bolt-on

3i's French portfolio company Trescal, an industrial calibration company, has acquired Austrian calibration service business Isocal GmbH.

Dunedin's Hawksford acquires Key Trust

Dunedin has acquired wealth management business Key Trust Company Ltd through its portfolio company Hawksford.

A Plus and Promelys in €3m round for Greenweez

Promelys Participations has joined existing investor A Plus Finance in a €3m funding round for French e-commerce player Greenweez.

Gimv et al. invest €5.5m in pharma company Multiplicom

Gimv and regional Belgian players have invested €5.5m in Antwerp-based biotechnology company Multiplicom NV.

Newfund injects €1.5m into Camping-Car Park

Newfund has provided French caravanning sites operator Camping-Car Park with €1.5m of funding.

CRB and Inveready back Amadix

Spanish VC investors CRB Inverbio and Inveready have injected €2m into biotech firm Amadix.

Enterprise Ventures backs Ph.Creative

Enterprise Ventures has invested ТЃ500,000 in Liverpool-based marketing agency Ph.Creative from its North West Fund for Venture Capital.

IMI.VC backs Game Insight with $25m

Russian investor IMI.VC has invested $25m in Moscow-based mobile gaming network Game Insight, valuing the company at $550m.

Oraxys in €21m round for Leosphere

Cleantech investor Oraxys has injected €10.5m into French laser measurement company Leosphere in what constitutes the first tranche of a €21m funding round.

MMC and Enterprise Ventures back Tyres on the Drive

MMC Ventures and Enterprise Ventures have provided ТЃ640,000 of follow-on funding for Tyres on the Drive.