Industry

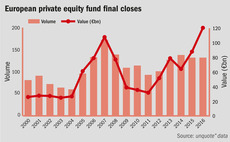

European fundraising surpasses pre-crisis high

Funds investing in Europe raised €120bn in 2016, up 37% on the year before

GP Profile: Bain Capital

GP is currently investing from its $3.5bn fourth European buyout vehicle, which closed in 2014

Bridgepoint hires KPMG's Holley as head of ESG

New recruit joins the GP after three years leading KPMG's responsible investment operations

Denmark suffers from lack of newcomer buyout firms

Country lags behind its Nordic counterparts in terms of new private equity players, despite a growing number of buyouts

Céréa promotes two in debt and mezzanine teams

Marjorie Manet is promoted to director and Alexandre Durst to investment director

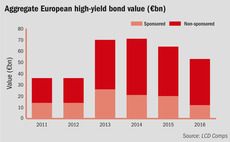

High-yield issuance for PE buyouts hits six-year low

Loan market flexibility and pricing steal the limelight as high-yield market for buyouts raises lowest total since 2010

Chinese investors bring exit opportunities but inflate entry prices

Research reveals GPs are noticing an increased appetite from Chinese backers for European assets

EQT to onshore all funds in Luxembourg, ditch UK post-Brexit

Brexit-driven uncertainty has ruled out the UK as a future jurisdiction for EQT funds, COO Casper Callerström tells unquote"

Pemberton hires Lack as COO

Prior to joining Pemberton, Lack was COO at the UK-based wealth management firm Brewin Dolphin

UK private equity's northern awakening

North of England is well positioned for substantial PE-backed growth in the coming years, accelerated by infrastructure investment

Private equity must wise up to cybersecurity

Private equity practitioners must act to avoid becoming the newest soft target for cybersecurity attacks, says Nazo Moosa from Riyad Taqnia Fund

Placement agents: Adapt to succeed

Evolving fundraising landscape means placement agents are having to reinvent themselves to future-proof their offerings

Mediterrania launches €250m third North Africa fund

Beside the GP's traditional focus on North Africa, the fund also targets sub-Saharan companies

Bridgepoint looking to raise further capital for Special Opportunities strategy

The capital pool would be deployed in France-based SMEs in challenging financial situations

Stirling Square appoints Hauptmeier to DACH team

Hauptmeier will contribute to the firm's investment activities in the DACH region

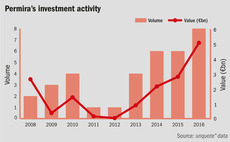

GP Profile: Permira

Global large-cap investor closed its latest buyout fund on €7.5bn in February 2016, making three investments from it to date

Lyceum appoints Greensmith to north-of-England team

New recruit will head up the north of England team as the GP looks to boost its presence in the region

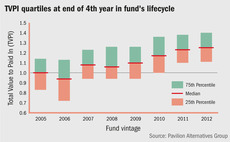

Strong returns: Are managers or the market due credit?

Beneficial exit market of recent years may not endure the next PE cycle, raising questions as to how strongly LPs should reinvest in the asset class

Tikehau lists on Euronext Paris with €1.5bn market cap

French investment fund Fonds Stratégique de Participations is also joining Tikehau's shareholder base

LDC reshuffles senior team with six promotions

Grove, Souillard, Lyndon, Hurley, Bell and Gould will all take on new responsibilities

GPs and non-execs: Partners through thick and thin

Recent reports have questioned the logic behind appointing NEDs to portfolio companies, though there is little sign of GPs changing their approach

LGT buys Ares' debt funds manager European Capital

As part of the deal, the LP acquired the firm from US-based investor Ares Management

Portugal boosts southern Europe's 2016 resurgence

Recent uptick in the country's buyout activity mirrors similar investor appetite seen five years earlier in Spain

Kima-backed startup Heetch in limbo following court verdict

Ride-sharing app is deemed to be enabling unlicensed taxi operation by its users