Industry

French Tech initiative launches visa programme

France's new "tech visa" is designed to attract talent and investment into the country's startup space

Natixis hires two in Milan

Investment bank boosts its coverage and M&A branch in Milan with two senior appointments

Investcorp completes purchase of 3i's debt management arm

Deal marks the asset manager's largest strategic investment to date, almost doubling its AUM

How many more generalists can the Nordic PE market bear?

Competition for capital and assets in the Nordic region has skyrocketed to the point of possible oversaturation

Freshfields poaches five Paris-based partners from Ashurst

Guy Benda, Nicolas Barberis, Yann Gozal, Laurent Mabilat and Stéphanie Corbière leave Ashurst

Arle Capital to close in Q1 2017

Fund manager of listed LP Candover Investments recently divested stakes in two listed portfolio companies

UK consumer deals slump as GPs heed Brexit warnings

Strong consumer spending figures in the months following the EU referendum have not translated to increased PE investment in the sector

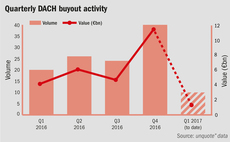

Quiet start to 2017 for DACH buyouts following Q4 flurry

Number of large German deals saw the DACH region outpace its European neighbours at the end of 2016, in terms of aggregate value

Catalyst hires Silk and Cox

London-based corporate finance outfit adds Alex Silk and Shannon Cox to its team as principals

In Profile: Ardian

Celebrating its 20-year anniversary in 2016, the GP has differentiated over time with funds covering multiple investment approaches

Maven to manage £58m for Northern Power House fund

Fund will buy ТЃ50,000-2m equity tickets in small-and medium-sized businesses

UK LPs expect distributions to drop in 2017 – Rede survey

Investors remain hungry for PE exposure as placement agent Rede Partners launches biannual report on LP sentiment towards PE

Debt advisory: Holding the cards in sell-side processes

Advisory firms often hold all the cards when pre-emptively introducing potential lenders to future sales processes

Bruno leaves Clessidra after eight years

Departure follows the recent depearture of the GP's former chairperson, Francesco Trapani

Debt advisory: Building bridges between sponsors & lenders

Debt advisory role is growing increasingly prevalent in the European mid-market private equity space

MBO Partenaires appoints Xavier de Prévoisin to partner

De Prévoisin becomes the French buyout firm's sixth partner

Lonsdale promotes Evans to partner

Ben Evans becomes a partner after eight years at the PE firm

Nordic onshoring remains elusive without political assurances

Tax transparency in the Nordic region will only improve slowly without political assurances

Keensight hires Cohen as partner and COO

Arnaud Cohen joins the French outfit after a long stint in EY's transaction advisory services team

New government may jeopardise Romanian progress

Results of December election follows year of record Romanian M&A activity and strong PE performance

In Profile: Apax Partners

GP closed its ninth fund in 2016 on its hard-cap of $9bn and recently made high-profile exits including the 2015 IPO of Auto Trader

Luxembourg the post-Brexit "jurisdiction of choice"

Country's RAIF structures, coupled with Britain's "wait and see" status, are luring more funds to Luxembourg

Q4 Barometer: Large-cap deals boost value in a shrinking market

Spike in megadeals boosted aggregate deal value in Q4, though volume was down 20% year-on-year

21 Centrale organises succession with Barbier promotion

Founding managing partner Gérard Pluvinet will step down to join the supervisory board in 2019