Industry

The unquote" forecast: Total buyouts fall by 22% in 2012

After buyouts picked up again in 2010 and 2011, this year's forecast predicts a drop in both value and volume. Anneken Tappe reports

Blackstone records strongest quarter since IPO

The Blackstone Group beat expectations with its positive earnings report, showing a strong recovery year-on-year.

LP highlights misalignment of interest with GPs

LP slams GP fees

World Bank commits $15m to Mediterra Capital fund

Mediterra Capital Fund I has received a $15m commitment from World Bank's investment unit International Finance Corporation (IFC).

Elbrus Capital Fund II gets $20m commitment from World Bank

Elbrus Capital's second fund has received a $20m capital commitment from World Bank's investment arm International Financing Corporation (IFC).

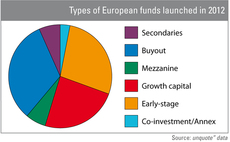

Secondaries and mezzanine vehicles proving popular in 2012

Looking at the funds launched so far this year in Europe shows sustained appetite for mezzanine and secondaries vehicles, reflecting current investment opportunities and subsequent LP interest for the private debt and secondaries markets.

Palio plans £150m debt fund IPO

Debt fund Palio is planning an IPO to raise more than ТЃ150m for investment in debt opportunities for UK lower mid-market companies.

German funds: The LPs' verdict

LP verdict

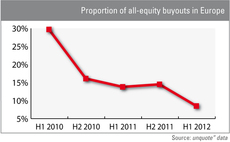

Spread between leverage and all-equity deals widens on investor scepticism

All-equity deals are decreasing as a percentage of overall buyouts, indicating investors are adopting a "wait-and-see" approach to financing.

Survey highlights extent of LP/GP perception gap

LPs and GPs still hold vastly divergent views on key aspects of their relationship, with terms & conditions and communication being the major areas of conflict, according to recent research by Acanthus.

unquote" Awards: Winners announced

Awards winners

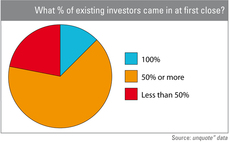

Fundraising research reveals optimism in tough times

Despite talk of apocalyptic investor behaviour, most GPs announcing a close this year reported existing LPs re-upping Т and even increasing ticket sizes, as revealed in an unquote" survey of more than 40 European GPs. Anneken Tappe reports

Blackstone and Anacap set up joint venture for financial assets

The Blackstone Group and Anacap Financial Partners have set up a joint venture to buy European financial assets.

Video: David Currie - industry needs liquidity

As he steps down from 33 years in private equity, most recently with SL Capital, David Currie shares his views on the industry's future.

French PE industry "could collapse", AFIC warns

French PE industry

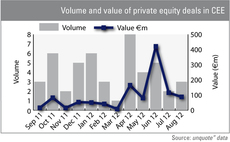

CEE picking up the pace

Dealflow in the CEE region picked up slightly in August, and the handful of deals closed so far in September hints at a busy Autumn ahead.

Gimv reshapes strategy to boost future growth

Belgian GP Gimv has announced an overhaul of its strategic orientation and management team, in order to strengthen its position in the industry.

Amundi takes 7.5% stake in French GP NextStage

French asset manager Amundi has bought a 7.5% stake in small-cap specialist NextStage from financial holding Artémis.

Can social capital convince investors?

Prime Minister David Cameronтs much vaunted тBig Societyт project finally got off the ground this month with government-established investor Big Society Capital (BSC) making its first commitments.

Video: Pinebridge's Rhonda Ryan

LP video interview

Chinese hungry for German assets

Recent studies by Rhodium Group and A Capital have suggested that Chinese investors could be in the early stages of a global shopping spree with direct investment into Europe tripling in 2011 to $10bn. With Germany being the most popular market for Chinese...

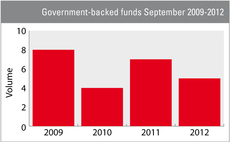

2012 sees fewer state-backed funds

Fewer government-backed funds have been launched in 2012 than in previous crisis years, suggesting that either the market is picking up, or that even governments' aid efforts are failing.

Sovereign wealth funds buy 10% of CVC

Three sovereign wealth funds - two Asian and one Middle-Eastern - have bought a combined 10% stake in CVC Capital Partners' management company, according to reports.

HIG Capital launches European credit business

HIG Capital has launched in London the European operations of its US credit business, HIG WhiteHorse, and appointed Haseeb Aziz as managing director in the new unit.