Industry

Majority of LPs happy to commit without in-person meeting – survey

Cebile Capital survey finds that 51% of respondents expect to increase PE commitments in 2021

Quantifying PE's appetite for recurring revenue models

Buyouts in sectors where recurring revenue models are predominant went from 8% of European volume in 2010 to 22% in 2021 to date

Cadence Growth Capital hires Kamphans

Niko Kamphans is to join the B2B technology-focused GP as an investment professional

Sharp focus on top assets boosts average multiple in consumer sector

Covid-resilient assets are the only ones coming to market, with suitably hefty price tags, says Clearwater's O'Donnell

Alantra buys 40% stake in MCH Investment Strategies

Through this partnership, Alantra expects to expand its financial service offering and enlarge its investor base

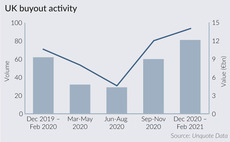

How UK PE buyouts soared ahead of 2021 Budget

Amount of dealflow in the past three months is significantly higher than in previous December-February periods

Nordic players await distressed carve-out uptick

Carve-out activity in the Nordic region hit a three-year low last year, but was still propped up mainly by corporates divesting healthy assets

Biotech market provides dose of optimism

In the past year, the biotech market has seen buoyant activity, reaching record levels of investments

Download the March 2021 issue of Unquote

The latest issue of the Unquote magazine is now available to our subscribers

Investcorp appoints Kohli as head of European IR management

In his new role, Kohli will be responsible for Investcorp’s investor relationship management, execution and strategy

No need to panic about high dry powder as PE market comes roaring back, says Bain

Appetite remains high for deal-making and exits, according to Bain & Companyтs 2021 Global Private Equity Report

FRP buys Spectrum Corporate Finance

All 27 Spectrum employees will join FRP following the ТЃ9.4m deal

France: strong deals pipeline fuels high average entry multiple

Sponsors fight tooth and nail for prized assets in defensive sectors such as healthcare, higher education and financial services

August Equity hires Walsh, Stevens and Coates

UK-based PE firm August Equity hires Greg Walsh, Mark Stevens and Michael Coates

QPE hires three

Queen's Park Equity has hired Alison Price, Valentina Matheus and Prudence Jones

GP Profile: Energy Impact Partners

EIP managing partner Matthias Dill discusses the firm's origination network, its sector focus, and impact investing in a more competitive era

Kempen appoints Willigers

Jorrit Willigers is to join Kepmen's private markets team as a director on 1 March 2021

Multiples Heatmap: average pricing hits 11x in busy Q4

Healthcare, financial services and TMT assets continue to drive valuations up, while Nordic and UK regions see highest multiples

17Capital hires Chatin as IR and fundraising director

Chatin will manage European investors, with an emphasis on French-speaking countries

Cipio Partners eyes March first close for eighth fund

Technology-focused investor's predecessor vehicle held a final close in July 2017 on €174m

Afinum back on road for ninth fund

Predecessor vehicle, which raised €410m in 2017, is now 86% deployed

3i invests in US-based WilsonHCG

Equity investment of $120m follows previous backing from Frontier Capital and CIP Capital

HQ Capital registers HQ Capital IV GP

Luxembourg-domiciled legal structure will allow HQ Capital to launch its next funds in 2021 and 2022

Sherpa appoints Retana as investment director

Retana has more than 10 years of experience in investment banking and private equity