Industry

Bifurcation in European fundraising: beat the traffic

Recent years have seen the growing polarisation of fundraising fortunes for GPs, with established managers able to raise faster than their peers

New Hampshire Uni to triple PE exposure

University would need to make new commitments of $18m per year to match its target allocation

EQT closes in on IPO – report

Swedish publication Affarsvarlden reports that the firm is in discussions with investors

TRS backs Astorg fund

TRS has invested 12.5% of its portfolio to private equity, versus a target of 15%

Calpers set to restructure its PE programme

Review of Pillar III and IV seeks scaling private equity exposure and a more cost-effective model

MUFG expands PE and Real Assets team

MUFG hires Citco Group's Andrew Stewart to drive the growth of the asset classes in EMEA

Connecticut to increase PE exposure in Europe

Proposal was outlined by the plan's alternative investment consultant Stepstone

GP Profile: Alantra Private Equity

Spain-based mid-market player has completed six deals in the past 12 months and is focusing on expanding and managing its current portfolio

Level 20 launches new committee in Spain

Committee's strategy will be aimed at attracting women to the private equity industry in Spain

Border to Coast outlines strategy for PE

BCPP targets global exposure in private equity across North America, Europe and Asia

Advent International set to secure US LP commitments

Advent International GPE IX has a target between $15-17bn and plans to hold a final close in mid-2019

IK launches Copenhagen office

Office will be led by Danish national and partner Thomas Klitbo, who has been with IK since 2007

Q&A: JCRA's Benoit de Bénazé

Some GPs are combatting risks arising from turbulent politics and economic uncertainty by making more frequent use of currency and risk hedging instruments

Michigan pension fund targets lower-mid-market PE commitments

Focus of the PE division to tilt slightly toward the mid- and lower-mid-markets

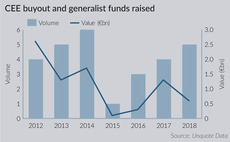

CEE fundraising activity promises buyout revival

Fundraising in the region held strong in 2018 in contrast to the rest of Europe and promises to be even stronger in 2019, even as dealflow slumped

AP6 invests in Accent's Hoist

Accent retains the majority and the company's founder, Malcolm Lindblom, will keep his share

Connection Capital appoints new head of funds

Robertson's appointment comes as private investor appetite for specialist alternative asset funds grows

Benelux trade deals surged in 2018

Exits to strategic buyers accounted for 56% of all divestments, with the volume of such deals increasing by 68% year-on-year

Nordea launches impact fund in partnership with Ståhlberg

Fund invests in companies that contribute to achieving the UN Sustainable Development Goals

EC reduces charges for insurers in PE

Insurance companies accounted for just 8% of European private equity fundraising in 2017

Unquote Private Equity Podcast: European tour

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team examines the key takeaways from IPEM and SuperReturn

Calpers seeks investment consultants

New contract is expected to start in July 2020, and would be three years long

Japanese pension fund seeks to increase PE exposure

¥150tn ($1.5tn) fund can invest up to 5% of its assets in alternatives, including private equity

GCA Altium promotes Stelten and Weber

Stelten and Weber joined GCA Altium in 2013 from DC Advisory and have been promoted to managing directors