Industry

Electra fails to find buyer

Development comes at the end of a formal sale process seeking buyers for the firm or its portfolio

Benelux industrials booming and primed for internationalisation

Sector soars past consumer in terms of aggregate value of H1 buyouts, having historically attracted similar levels of PE backing

AP3 increases allocation to PE

SEK 353bn state-owned pension fund announced a total return of 3.3% from its entire portfolio

Certior holds €51m first close for Credit Opportunities Fund II

Fund focuses on the European SME direct lending segment, in particular in seeding emerging managers

Maples and Calder appoints seven new partners

Firm also appoints three counsel in its Cayman Islands and Dublin offices

Northern Pool launches £720m PE vehicle

Pooled fund is designed to reduce fees and reliance on funds-of-funds, while boosting co-investment

Healthcare under observation among European GPs

Digitalisation and vendors that are increasingly receptive to PE are providing opportunities in the sector

Alternative investments deliver strong returns for AP2

Private equity represents roughly 5% of pension fund's portfolio, up from 1% in 2008

Genesis hires senior investment analyst

Tomáš Sýkora will be responsible for finding investment opportunities and overseeing portfolio companies

Summa Equity hires Anna Ryott as chair

Board of directors will include several newly elected members with backgrounds in sustainability

Nordics investors remain active but cautious

H1 buyouts drop in the Nordic region after a busy 2017 as SBOs and trade sales take off

Aurelius opens new London office, appoints two

GP launched its London office five years ago and has since grown it from five to 20 employees

Standard Chartered to sell PE division in ICG-backed deal

Transaction will see ICG acquiring $1bn of assets from the vendor and injecting fresh capital

Penta-backed GRP buys Digney Grant

GRPтs Irish division Abbey Bond Lovis, a retail broking specialist, buys a majority stake

International appetite for Spanish deals soars in H1

Country's dealflow and aggregate value both reached record or near-record levels in H1, with international GP's fueling mid- and large-cap activity

Weekly round-up: PE hot for insurance sector; French mid-cap seeks new approaches; and more

Catch up on essential news and features from this past week with our round-up of industry analysis

PE outperforms other alternatives for foundations – report

More than 220 foundations participated in the study, representing around $104bn of assets

Mercer acquires Pavilion Financial

As part of Mercer, Pavilion's clients will have access to the firm's investment capabilities

Florida pension fund PE returns beat benchmark

Private equity has driven results for the entire portfolio, which returned 8.98% for the same period

Rede hires Amala's Simpson

Rede's seventh hire this year, most recently following the appointments of Joseph and Camacho

PE drives returns for Maryland pension fund

Public pension fund has also increased its allocation to private equity to 12.5%

Headway invests in restructuring of Alter Capital fund

GP established a new vehicle, Alter Cap II, to purchase the fund’s portfolio and provide capital

PE delivers best returns for Keva

Finnish pension fund announces it generated returns of 7.3% from its private equity portfolio

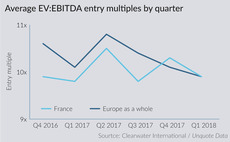

French mid-cap seeks new approaches as competition heats up

Buy-backs edge into the French mid-market, as H1 activity hits record highs and entry multiples swell