Industry

Private assets spurring returns for CPPIB

Investment portfolio has generated 1.8% of annualised net nominal returns for the first quarter

ADM exits its CEE private equity business

Move enables ADM to focus on its Asian fixed income business, Cibus Fund and ADM Capital Foundation

Bridgepoint sells minority stake to Dyal Capital

Mid-market GP will expand its range of investment approaches and expand internationally

PE hot for insurance sector

Dealflow and aggregate value in the insurance sector has surpassed its post-crisis annual peak before the end of the third quarter of 2018

Calper's committee to revise PE programme

Investment committee will also discuss whether to extend its contracts with its investment consultants

Nystrs considering further European fund commitments

US pension fund has increased the number of active partnerships in its private equity portfolio

Strong exit environment helps drive Pantheon's returns

Sales to corporate buyers were the most significant source of exits, PIP says in its results

BGF on track for busiest ever year

With five months to go, the UK investor is already just a few deals shy of its record deployment year

Fee structures: adventures in LP flexibility

As private equity continues to outperform other asset classes, some GPs are exploring new fee structures, with mixed results

Riverside promotes Álvarez-Novoa to partner

Firm also appoints Filip Van de Vliet and Philip Rowland as operating partners

Hamilton Lane asset footprint hits record high

Firm plans to keep growing its existing funds across primary, co-investment and secondary strategies

US pension plan seeks private equity manager

Candidates should have at least five years' experience in managing private equity funds

MMC appoints three

Morgan will take the role of chairman, having previously held the post of CEO at the Daily Mail

Dyal Capital makes minority investment in Golub Capital

All proceeds from the deal will remain invested in the firm and there will be no change in strategy

LP Profile: Allianz Capital Partners

Co-head of PE Michael Lindauer speaks to Unquote about the firm's history and approach to investment

Debevoise hires Kirkland's Dickman

Dickman will be responsible for fund formation, management and reorganisation advice

CEE dealflow drops in H1 as exits soar

Buyout activity in the first six months of 2018 was at the lowest H1 level seen since 2009

Ogier promotes two

Delamarre and Elslander earn promotion to senior associate after joining the firm in 2014 and 2016

Alaska Permanent PE returns hit historic high

Private equity portfolio is now valued at $7.3bn, representing 11.2% of total assets

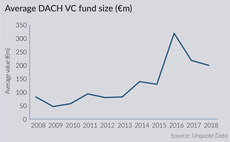

VC fundraising lifts off in DACH region

Six venture funds based in the DACH region have held final closes in 2018 for a combined €1.3bn

Q2 Barometer: European private equity hot streak continues

Average European PE deal value hit a post-crisis peak in Q2, while quarterly volume reached the highest level on record

Private equity boosts returns for Ohio pension fund

SERS generated a net return of 9.17% from its entire portfolio for the same period

Italian pension fund to commit to three PE funds

Potential candidates must have a track record of three years' experience in alternative investments

Altamar appoints González and Utrera as COOs

González and Utrera will report to the firm's founding partners and co-CEOs Aguirre and Molina